Small Cap Rally is No Turkey

November 23, 2016

In the two weeks since the U.S. presidential election we have seen wide swings in different areas of the financial markets, but one of the clear winners has been U.S. Small Cap stocks. Why have small caps “trumped” the performance of other asset classes? We think there are a few reasons:

- President-elect Trump won on a platform of protectionism and “anti-globalization” which would tend to benefit smaller companies. In talking with clients, we have used the example of a global company trying to sell toothpaste to Bangladesh vs. an Ohio-based company trying to sell products to Kansas. Under Trump’s proposed policies, smaller domestic companies have an advantage.

- The Trump plan to cut the corporate tax rate to 15% likely benefits small companies more than large companies. Smaller companies are less likely to deploy complex tax reduction strategies, and as a result, might be better positioned to reap the benefits of closed loopholes and lower tax rates.

- Less regulation, which is also a key part of Trump’s economic plan, may also favor small companies as they have less ability than large companies to pay large compliance costs.

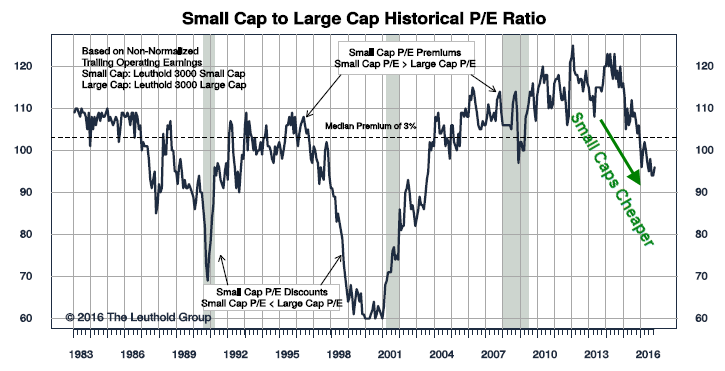

After largely drifting sideways for the last two years, the sharp rally in small caps has made us take note and we respect the momentum. Also, a variety of valuation measures show that small cap stocks are trading below their historical averages relative to large caps. The chart below shows an example. The line on the chart reflects the average Price to Earnings (P/E) ratio of small cap stocks relative to large caps. When the line is moving up, it means small caps are getting more expensive and when the line is moving down it means small caps are getting cheaper. As the chart shows, small caps have been getting cheaper relative to larger companies since 2013 and are now at their cheapest levels (relative to large caps) in over 10 years.

Source: The Leuthold Group

We don’t like adding to positions when the price has already moved up, but we think the rally in small caps has the potential to continue. With strong momentum, the potential for favorable fiscal and regulatory policies, and relative valuations below historical averages, we think the case for small caps is solid and will be looking for opportunities to increase our clients’ exposure to small cap stocks within their portfolios.