Small Cap Stocks and Contrarian Thinking

June 3, 2022

To Inform:

If you’ve been reading these WealthNotes for a while, you may have gotten a sense that we value contrarian thinking when it comes to investing. This is never easy to do – human nature makes it very hard to zig when the rest of the crowd is zagging. But sometimes that is precisely what one must do. A quote I recently came across attributed to Bob Farrell, chief stock market analyst at Merrill Lynch decades ago, gets at the importance of thinking this way. Farrell said, “When all the experts and forecasts agree – something else is going to happen.” In other words, when everyone agrees on the attractiveness of a trade or an asset class, you can put pretty good odds on the crowd being wrong. At best, you get market-like returns, at worst, you come out sorely disappointed.

Where are we seeing contrarian opportunities today? While some of the really obvious fat pitches aren’t quite as fat as they were months or quarters ago, one big one seems to be floating out of the pitcher’s hand. The pitch? Small cap stocks. Academics will debate whether or not there is a “premium” (above market return) associated with owning small caps. We’ll ignore that debate for now and simply look at valuations. The chart below from JPMorgan shows the valuation level of small cap stocks on a forward basis (today’s price divided by estimates of future earnings) going back to the mid-1990s. What we see is that outside a brief moment in the 2008-09 financial crisis, small cap stocks have rarely been this cheap.

Source: JPMorgan Asset Management

Skeptics of small caps in today’s environment might ask questions like, “what if we go into a recession?” or “what if interest rates keep rising?” The answer would be that’s bad news for stocks in general, and earnings would take a hit. But as we’ve seen this year with foreign stocks, when the multiple investors are paying for these stocks is low enough, they can handle plenty of bad news!

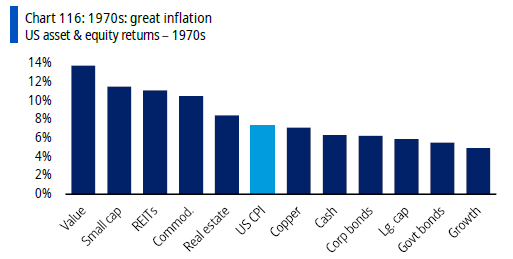

On the positive side of the ledger, we think corners of small cap stocks offer us some protection from the possibility of “higher for longer” inflation, deglobalization, and higher interest rates. We’ve maintained for some time that we aren’t of the view that inflation goes to levels seen in the 1970s. What we do think is that there could be some “rhyming”. The corners of the market that did worst that decade were bonds and growth stocks. Sounds familiar. The things that worked that decade were value stocks, small cap stocks, and real assets, as the chart below attests.

Source: BofA Global Research

Going into the 1970s the crowd was enamored with the “Nifty Fifty” stocks. Those were the blue chip, growth darlings of the day. As history will attest, the crowd was sorely disappointed. The contrarians, however, were poking around in small cap stocks, in value, and in commodities. Those contrarians, led by none other than Warren Buffett, were able to thrive in an otherwise challenging decade. Are contrarians always right? Of course not. But the batting average is pretty good. Our task is to find those unloved corners of the market, build a thesis, and swing.

Written by Alex Durbin, Portfolio Manager