Small Caps, Value Style, and Foreign Stocks are Cheap – Watch the Yield Curve and the Dollar for Catalyst

January 31, 2020

To Inform:

Earlier this week we held a successful Portfolio and Pints event where we unpacked The Joseph Group’s “Top 5 Investment Themes for 2020.” For those who were unable to make the event, we also plan to feature some of those themes over the next few weeks in the “To Inform” portion of WealthNotes.

Our “Top 5 Investment Themes for 2020” reflect the major discussion points we are currently having in our Investment Strategy Team meetings. These themes are driving the way we are positioning client portfolios as well as driving the factors would lead us to make changes within those portfolios.

This week’s theme is “Small caps, value style, and foreign stocks are cheap – watch the yield curve and the dollar for catalysts.” With the spirit of looking to “buy low and sell high,” here is what we are thinking.

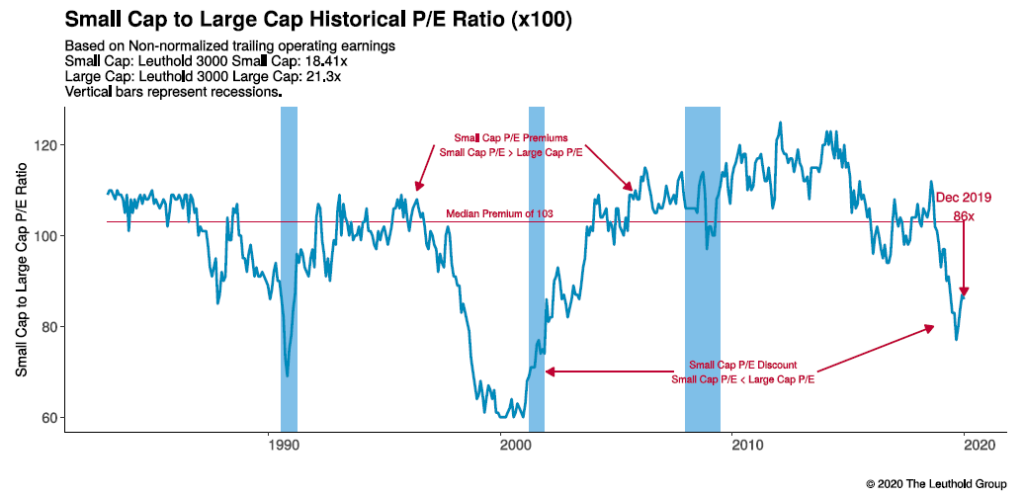

Small company stocks are cheaper than large company stocks. The chart below shows the valuation relationship (based on price to earnings, or P/E) of small company stocks to large company stocks going back to 1983. When the line goes down, it implies small stocks are trading a lower valuation relative to large stocks (and vice versa). Although not quite as extreme, the last time relative cheapness was similar in the last 40 years was in the midst of the 1999-2000 technology bubble.

Source: The Leuthold Group

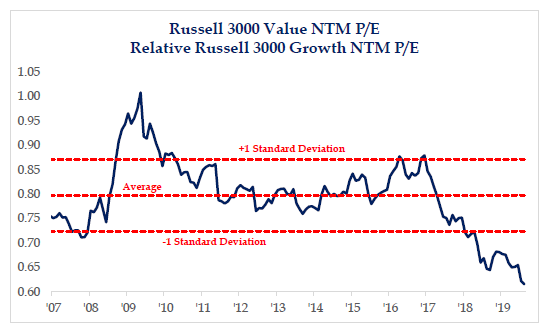

Value stocks are cheaper than growth stocks. Here is another chart where the line going down means less expensive and the chart is showing that value stocks are at a statistical extreme relative to growth stocks. With big technology names dominating market performance the last few years, other stocks and sectors (think energy, financials, some areas of health care) are relatively cheaper. Ironically, the last time the historical extreme between value and growth was this large was in the 1999-2000.

Source: Strategas Research Partners

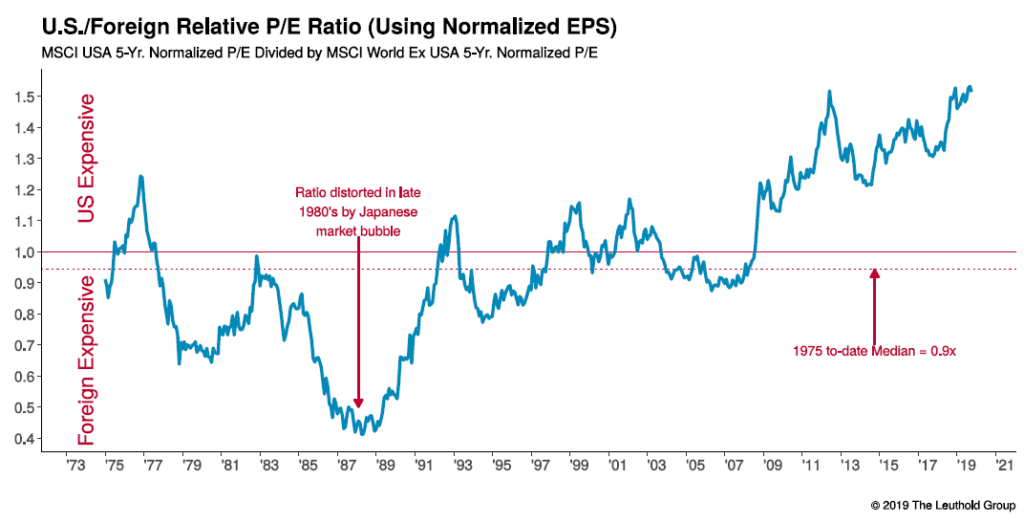

International stocks are cheaper than U.S. stocks. In this third chart, the line moving up means expensive and the chart is showing valuations of U.S. stocks are at the highest levels relative to foreign stocks at anytime in the last 50 years. In other words, U.S. stocks are relatively expensive and foreign stocks are relatively cheap.

Source: The Leuthold Group

So, small caps, value stocks and foreign stocks are cheap – does that mean they will outperform? We wish it was that easy. Something that is cheap in the market can stay cheap for a long time. In order for something to outperform, it needs a catalyst. And we are looking for that catalyst in the form of a steeper yield curve (meaning longer term interest rates are higher than shorter term interest rates) and a weaker dollar. The Joseph Group Investment Team recently attended a due diligence event at a mutual fund company. During the event, the question was asked – “back in 2000, did anything happen that coincided with value stocks starting to outperform?” The portfolio manager answered, “Actually yes. When longer term interest rates started going up that’s right around the time value stocks started outperforming.” The portfolio manager went on to add that back in 2000, the math around their valuation models changed when longer term interest rates were going up and that change was unfavorable for growth stocks. Understanding the nuts and bolts around that math, we think something similar could happen today if longer term interest rates moved up.

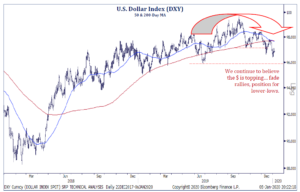

We’re also watching the value of the U.S. dollar. If the dollar weakens, it’s favorable for foreign stocks because the lower the dollar goes, the more dollars you can buy with other currencies. In fact, as the dollar weakened last November and December (see chart below), we saw foreign stocks, especially emerging markets, outperform.

Source: Strategas Research Partners

The bottom line is Small caps, value style, and foreign stocks are cheap, but we are watching the yield curve and the value of the U.S. dollar as signs a change in market leadership could take place.