Social Security Update

July 18, 2025

To Inform:

Yesterday, I was in a client meeting with a beloved friend who had a long career in public service. As we were talking about investments and his family’s terrific looking financial plan, he said, “oh, I forgot to tell you – my Social Security went up by about $1,000 per month because of the Social Security Fairness Act passed last year!” I replied by saying, “we will update the income number and that’s just going to make your plan look that much better!”

I have had people I love and care about impacted positively by last year’s passage of the Social Security Fairness Act which increases benefits for some public workers and their families. After my dad passed away last June, my mom moved into an independent living facility in Texas. As a teacher all her working career, my mom was one of the beneficiaries of receiving an increase in her benefits, which is going a long way to paying her monthly expenses. It’s a blessing to our family.

However… the other side of the coin is that a few weeks ago, the Social Security Trustees, in their 2025 annual report, projected what is referred to as the “Social Security Trust Fund” (the combined Federal Old-Age and Survivors Insurance and Federal Disability Insurance (OASDI) Trust Funds) will likely be depleted in 2034. The passage of the Social Security Fairness act has slightly accelerated this timeline.

Does this mean it’s time to panic about Social Security? JP Morgan retirement strategist Sharon Carson says, “despite its funding challenges, the entire Social Security benefits program is not about to disappear.” Based on a report by JPMorgan, let’s look at dispelling a couple of myths about Social Security.

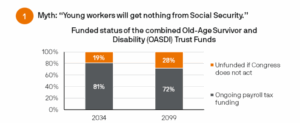

First, there is the idea that once the “Trust Fund” is depleted (unless Congress acts!), Social Security will go away and that’s simply not true. Check out the chart below. If nothing happens and the trust fund is depleted in 2034, Social Security trustees believe there will be enough ongoing revenue, mostly from payroll taxes, to cover 81% of benefits. Looking further into the future, all the way out to 2099, Trustees project there will still be enough revenue coming in from payroll taxes to fund 72% of benefits. We view this as “worst case scenario.” Congress may decide to make changes in the years ahead, even if those changes are unpopular. But even if they don’t, income from current payroll taxes will continue to fund benefits. Social Security is NOT going away.

Source: JPMorgan, Social Security Trustees Report

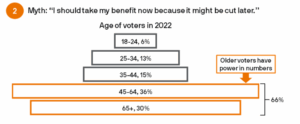

Older workers should also note most voters are over age 45. Potential changes which may be made to Social Security are anyone’s educated guess, but the simple reality of where the voters are would seem to imply younger workers would bear the brunt of the impact. Even if there are benefit cuts, it seems likely to us older workers would probably receive gradual changes.

Source: JPMorgan, Kaiser Family Foundation

We receive the question A LOT: “will Social Security exist in the future?” The answer is YES! Tax law changes from last year’s Social Security Fairness Act and the recent passage of the “One Big Beautiful Bill Act” do reduce revenues and increase expenses for the Social Security program and could accelerate the date for the “Social Security Trust Fund” to be depleted. That means we may need to play with a few more “what if” scenarios in our planning software. BUT, Social Security will continue to exist and remains an important income source for retirement planning for older and younger workers alike.

Written by Travis Upton, Chief Executive Officer