State of the Race

November 1, 2024

To Inform:

This time next week we’ll (hopefully) know the winner of this coming Tuesday’s presidential election. There are enormous policy implications of a Trump or Harris administration and today the race sits on a knife’s edge. We’ll sort through a few key indicators – polling, betting markets, and market action – to get a sense for where the race sits and what the implications might be post-election. Buckle up, we’re going in.

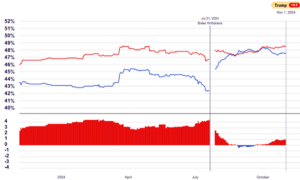

First, with the polling, the race is closer than it’s been in several election cycles. The national polling average shows a slight edge for former President Trump, with a 0.3% advantage across 14 unique polls. The range of these polls is very tight. The largest margin for either candidate is 3%, with Trump leading in 6 polls and Harris in 5 and the remaining 3 being tied. On this date in 2020, Vice President Biden led Trump by 7.2% with advantages in 13 of 13 final polls. In 2016, Hillary Clinton led by 3.2% with advantages in 9 of 10 final polls.

Source: Real Clear Politics

In the key battlegrounds, the polls are nearly as tight, with Trump leading by 0.9%. Of these, Vice President Harris is strongest in the Rust Belt with small leads in Wisconsin and Michigan and trails by 0.3% in Pennsylvania. Harris must all three of these to win the election. If Trump wins one of the three, his odds are very good assuming returns in the Sun Belt, where his leads are larger, break his way.

Source: Real Clear Politics

Betting markets are interesting, though the track record here is much shorter than the history of polling. Betting markets attract a wide swath of people in both the US and abroad to vote with their dollars on who they think will win the election. Where the race sits today, Trump enjoys 60.8% odds of winning, with a range of 58% to 63% across eight different betting markets. Here, Trump has led since the beginning of October after a handful of lead changes between the two candidates from July through September. In 2020, Biden maintained an edge that began in June that he never gave back and had 64% odds on the Friday before the election.

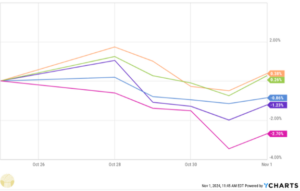

So, what about markets, that’s why we’re talking about this, right? Markets have a number of associated “trades” that are seen as expressions of one candidate over the other. Let’s start with the “Harris trade”. One of the research firms we subscribe to notes a handful of sectors and industries that are likely to benefit from a Harris administration. These include defense contractors (ongoing Ukraine war, other global conflicts) and consumer stocks (consumer staples companies, homebuilders, and retailers negatively impacted by tariffs). Countries like Mexico and China are also seen as relative winners in a Harris administration as it is thought she’ll be less of a trade hawk.

With names being withheld to protect the innocent, the chart below shows the performance of a few of these Harris adjacent trades and their performance over the last week. In all, not a clear signal here, other than to note that homebuilders and defense stocks have fared the worst over the last several days.

Source: YCharts

Trades associated with a Trump administration include a stronger dollar, small cap stocks (less foreign revenue exposure), and higher treasury yields on the view that Trump’s policies are more inflationary than Harris. Here, the data are little more shaded in Trump’s direction in recent days after significantly moving in Trump’s direction through the month of October.

Source: YCharts

We think these sorts of trades are good indicators of which sorts of sectors and companies would benefit from a Trump or Harris administration and would expect that these trades see more movement after the election is settled.

No matter what you’re looking at, whether it is the polls, the betting markets, or the financial markets themselves, it looks like it’ll be a very close race and that we’re in for an interesting election night and post-election market. Our mantra in these times is “policy, not politics”. Hopefully in the days and weeks to come we get more of the former and less of the latter!

Written by Alex Durbin, Chief Investment Officer