Stocks are Trumping Bonds for Income Investors

August 29, 2019

To Inform:

With interest rates across the world continuing to decline, a curious thing happened here in the U.S. this week. The interest rate on a 30-year Treasury, also known as the “long bond” dropped below the dividend yield on the S&P 500.

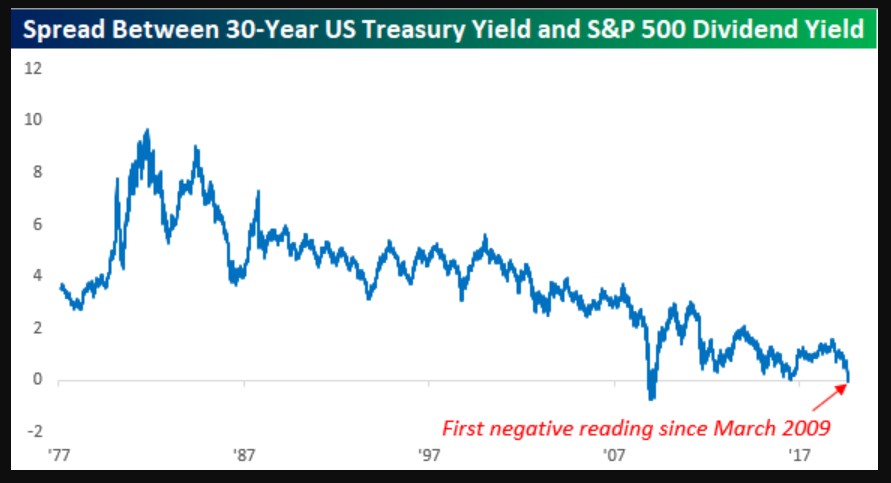

While not unprecedented, stocks paying more in dividend income than the long bond is paying in interest income is rare. The chart below shows the difference between the 30-year Treasury rate and the dividend yield of the S&P 500 going back to when the original Star Wars was released (1977). Back in the late 70’s/early 80’s, the interest rate on the long bond was about 10% more than the dividend yield on stocks. As interest rates have experienced a generational decline, the difference has gotten smaller, but the only other time in the last 40+ years the long bond rate dipped below the S&P 500 dividend rate was in the first few months of 2009. We’re in a different market environment today, but it is worth noting the last time stocks paid more income than bonds was a period where most investors wish they had a time machine to go back and buy stocks.

Source: BespokeInvest.com

Source: BespokeInvest.com

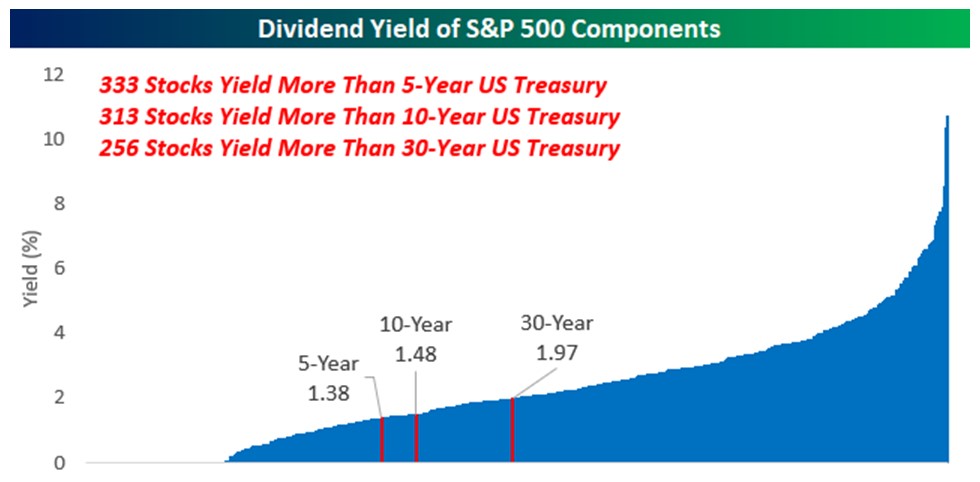

Income investors may also find the second chart interesting. The chart shows current interest rates on the 5, 10, and 30-year Treasury bonds and how many stocks within the S&P 500 have dividend yields greater than the bond rate. With the 30-year Treasury paying 1.97%, over half of the stocks in the S&P 500 have a dividend rate which exceeds that hurdle.

Source: BespokeInvest.com

Source: BespokeInvest.com

The phrase “long-term investor” is ubiquitous within the investment industry, but for the sake of argument let’s say 30 years is a good definition of long-term. At current valuations, an investor could loan money to the U.S. government (by buying a bond) and get paid 1.97% per year and their principal back 30 years from now. Or, the investor could buy stocks and experience a roller coaster ride but even if stocks had zero growth over 30 years, they would be better off than the bond investor by collecting their dividends.

We believe the relationship between income rates has important implications for asset allocation. For example, The Joseph Group’s Provision Strategy seeks to provide cash flow for investors who are making withdrawals from their portfolio. Within the stock sleeve of Provision, we seek to only buy dividend-paying stocks. Bonds may feel safer with the current trade, yield curve, and political turmoil, but are bonds likely to produce the best outcome for investors who need cash flow to fund their retirement withdrawals?

Our next Portfolios at Panera event is several weeks away, but we plan to talk about the difference between how it “feels” to own different asset classes vs. the outcomes those asset classes are priced to deliver. It should be a fun discussion and one we hope will pay dividends.

Have a great weekend!