Stocks Up but Earnings Estimates Down – What Gives?

February 21, 2019

To Inform:

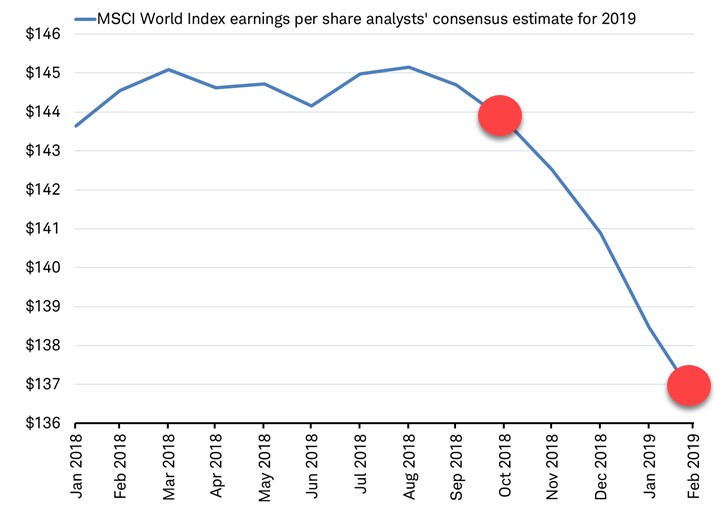

So far in 2019, stock prices have gone up but analyst estimates of corporate earnings across the world have been declining. The chart below looks at MSCI World (the entire global stock market) earnings estimates for 2019. Since October, the estimate for global earnings has fallen from about $144 per share to $137 per share (see the red dots), a 5% decline in expected earnings.

Source: Charles Schwab, MSCI data via Factset as of 2/15/2019

So, if earnings estimates are going down, why are stock prices going up? In short, it’s because multiples are expanding – investors are willing to pay more for those earnings as they have become more confident in the future outlook for interest rates and the economy.

Let’s look at the path the Price/Earnings (P/E) multiple of the S&P 500 has taken over the last six months as an example. In September of 2018, the P/E multiple on the S&P 500 was about 18x (implying investors were willing to pay $18 for every dollar of earnings produced by the S&P 500). When the market declined in December, the P/E multiple dropped to about 14.4x – investors were fearful and were not willing to pay as high of a multiple for corporate earnings. Today, the P/E multiple has increased from the December lows and sits at about 16.5x – slightly ahead of its 25-year historical average.

So, what are the implications of rising stock prices, but falling earnings estimates? There are two key things we are focused on:

- First, the market’s recovery that started this January could be getting into its later stages. Looking at U.S. stocks, P/Es are already around their historical average. The optimistic case is multiples return to their September level of 18x, implying about +1.5 more points of multiple expansion, or about 9% appreciation from here. That’s definitely not a bad return, but as momentum drives stock prices higher, it implies we should be considering reducing exposure to U.S. stocks.

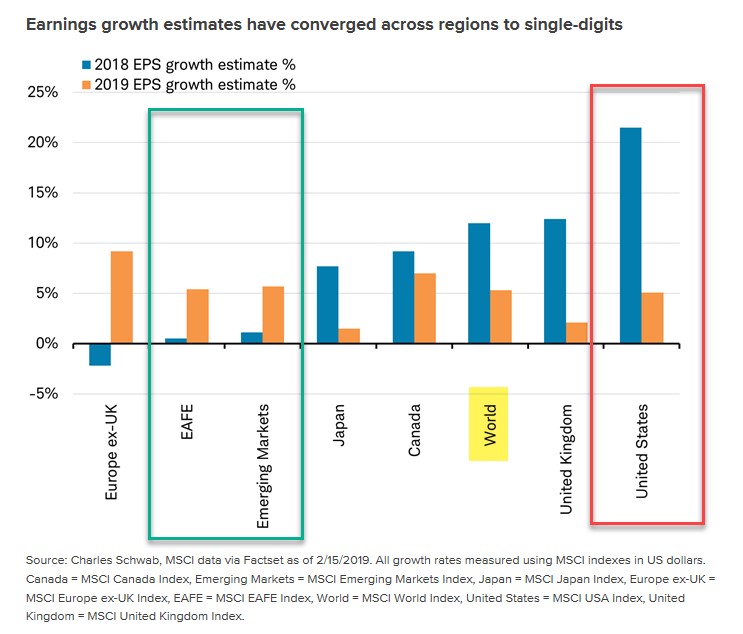

- Second, it is important to look at where earnings estimates are changing across the world. In the chart below, the blue bars reflect 2018 earnings estimates while the gold bars reflect 2019 earnings estimates. It is worth noting earnings growth for the “World” stock market in 2019 (highlighted) is still positive, just lower than it was a year ago. However, the region in the world with the biggest earnings growth decline is in the United States (where the impact of tax reform may be fading on a year over year basis) while we are actually seeing earnings growth estimates increase across areas of Europe and emerging markets.

Source: Charles Schwab

The convergence in earnings growth across the world implies a global approach to stocks continues to make sense throughout 2019. Also, being aware of the interplay between corporate earnings and multiples paid for those earnings help us identify risk levels and guide us toward where we want to overweight and underweight asset classes as we seek to achieve client objectives.