Taking Stock of Recent Data: Rates, Jobs, and Earnings

May 5, 2023

To Inform:

The turn of the calendar to the month of May this week has brought a flurry of economic and earnings data. Banks are obviously in the headlines, but let’s take a look at some of the big data points from this week and potential implications.

Rates

Jay Powell and the Federal Reserve increased short term interest rates this past Wednesday, taking the upper band of the Fed Funds rate range up by 0.25% to 5.25%. It’s been a fast rise in short term rates – a year ago (May, 2022) the upper band was only 1.00%. So, is the Fed finally done? The official Fed statement removed the language saying “additional policy firming may be appropriate” leading Wall Street to believe the Fed is making its case for a pause in rate hikes.

What about rates going forward? TJG’s own Andrew Burkey turned us on to a website the CME Group manages that looks at the probabilities of what the Fed will do at future meetings. Here are a couple snips from this morning’s data:

- Over 90% odds the Fed will hold rates steady at its next (June) meeting.

Source: CME FedWatch Tool May 5, 2023

- Three meetings from now (September) there are over 70% odds the Fed will begin cutting rates, with about 52% odds of rates being 0.25% lower than today and about 23% odds of rates being 0.50% lower than today.

Source: CME FedWatch Tool May 5, 2023

Jobs

The first Friday of the month is typically eventful because it marks the release of what is arguably one of the most important economic data points of the month – jobs. This morning’s report saw non-farm payrolls increasing by 253,000 jobs, beating Wall Street estimates of 180,000. Also, the unemployment rate declined to 3.4%, tying the lowest level of unemployment since 1969.

We would say the numbers here point to broader economic stability, which is welcome news in the face of recent liquidity struggles in the banking system.

Earnings

The jobs number wasn’t the only good news today. Last night’s earnings release from one of the United States’ largest technology companies was part of a string of better-than-expected earnings reports for the market. In general, first quarter corporate earnings have been far better than had been expected only a couple of weeks ago. Top line revenue growth has been better than forecast and margins have tumbled less than feared.

The charts below provide some perspective. Estimates for corporate earnings have been falling for most of the last year, and according to Bloomberg, “the index is pacing for a 4.5% decline in earnings year over year.” However, we remind readers that markets tend to respond more to “better or worse” than “good or bad.” Earnings and profit margins, which may still be lower than a year ago, but better than forecast a few weeks ago is likely supportive of markets.

Source: Bloomberg

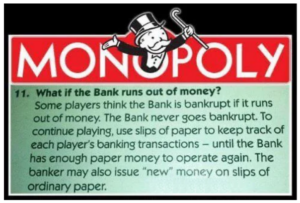

Finally, what about the banks? We are watching the current liquidity pressures, especially on banks in the headlines, and we believe the pressure to raise interest rates paid on deposits is likely to put long-term pressure on bank profitability. That said, with bank stocks rallying in the short term as I type this, it’s a good time to remind investors of “Rule Number 11.”

Source: Monopoly, Hamilton Lane, Twitter

We hope you enjoy the warmer weather and have a great weekend!

Written by Travis Upton, Partner, CEO and Chief Investment Officer