Taking Stock of the Recovery

October 8, 2020

It’s easy to get dragged into the daily gyrations of the stock market and take your eye off the ball in what’s happening with the “real economy”. The market reacted violently in the early stages of the Coronavirus pandemic but staged a rebound the likes of which have never been seen. We’ve gone into some of the “why” behind that rebound, but for markets to continue to perform in the months and quarters ahead, evidence that the real economy is rebounding needs to present itself. In this note, we’ll take off our stock market glasses and instead take a look at some key indicators of what’s happening in the real economy.

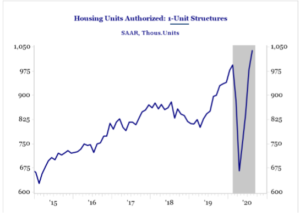

Source: Strategas

Housing has often been seen as a key lynchpin to economic growth in the United States. A strong housing market flows through into numerous areas of the economy. This chart shows that housing permits are, after a severe dip, now at their highest levels since the mid-2000s. To put this in perspective, annual household formation is somewhere around 1.2 million. Translation: the US needs lots of houses, many more than have been built over the last decade. This is a very encouraging sign. Homebuilding could be a source of strength as we navigate our way out of the Coronavirus pandemic.

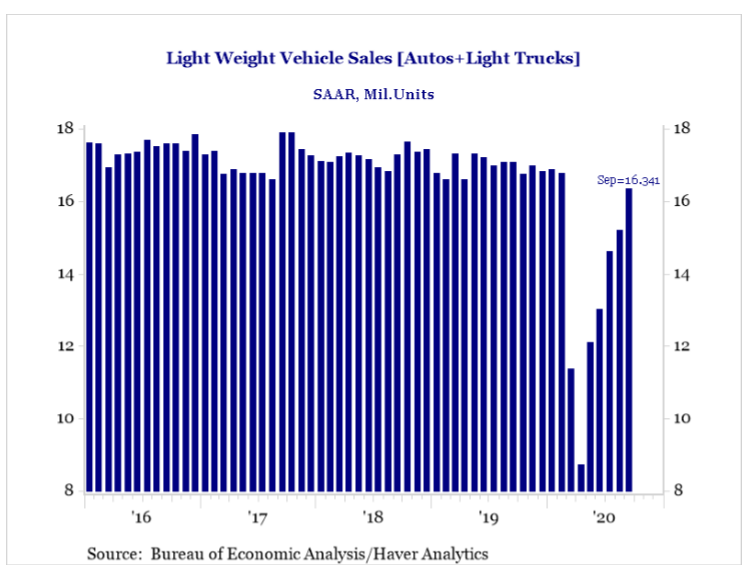

Automobile sales, another key economic indicator, are surprisingly strong after a marked drop off in early 2020. Annualized sales reached 16.3 million vehicles in September, not far from levels we saw in recent years that were some of the best ever for automakers. For this bounce to continue we will need to see further improvement in the job market and sufficient supply from automakers.

Source: Strategas

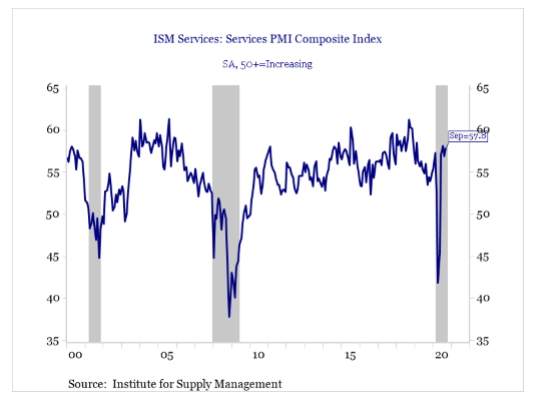

Finally, the Institute for Supply Management’s Purchasing Manager Indexes (PMI) for both manufacturing and services businesses showed continued improvement in September. For these indexes, a number above 50 signifies expansion, while a number below 50 signifies contraction. The nature of the Coronavirus pandemic and its economic effects explains how briefly these indexes were in negative territory. If we get the right mix of therapeutics, a vaccine, and a refrain from further lockdowns, it’s likely these remain in positive territory.

Source: Strategas

Source: Strategas

Market prognosticators have thought of all sorts of ways to describe the recovery from the Coronavirus pandemic. V-shaped, L-shaped, K-shaped, and so on. There may be some truth to all of these, depending on where you look. Where it really matters, though, things look pretty “v-shaped”. While we’re not out of the woods with respect to the pandemic, we’re better off now than we were 6 months ago. Keep this in mind when you’re tempted to look at market headlines or when you flip to CNBC and markets are red on the day.

This WealthNotes Inform was written by Alex Durbin, Portfolio Manager