Taking Stock of the Trump Trade

November 7, 2024

To Inform:

Wow. The U.S. stocks posted a massive gain the day after the election of Donald Trump as the 47th President of the United States. The popular Dow Jones Industrial Average was up 1,508 points (+3.6%) on November 6th and all of the most closely watched U.S. indices (Dow, S&P 500, NASDAQ) closed at record highs. We’ve had a lot of questions about why the one-day rally in the stock market was so sharp and we would point to three theories:

- Markets hate uncertainty and regardless of the feeling about the result (about half the country is happy and half the country is mad), the result was certain. Concerns we may not know the winner of the election for weeks proved unfounded.

- Trades betting on a contested result or a Harris win had to be unwound quickly resulting in buying pressure in certain areas of the market.

- The “Red Wave” with Republicans also taking control of the Senate and likely maintaining control of the House gives credence to the idea the 2017 tax cuts will be extended.

Our opinion is all these theories combined to play a role…now that the election is behind us, the market can shift from the emotion of politics to planning for potential future policies.

The market will be sorting through policy implications in the weeks ahead, but let’s look at what we can glean a few market reactions from the day after the elections:

Small Cap Stocks had a huge day, up +5.8% as measured by the Russell 2000 Index, which was more than double the 2.5% gain for the S&P 500. Smaller stocks are often thought of as being more economically sensitive, so the post-election surge could be looked at as a positive signal for future expectations regarding the economy.

Source: Bloomberg

Developed market foreign stocks (think European countries and Japan) declined about 1.5% on the day (as measured by the MSCI EAFE Index, but why matters. The stocks themselves were essentially flat and all of the daily decline can be attributed to a rise in the value of the U.S. dollar. The knee jerk market reaction clearly sees Trump as being associated with a stronger dollar.

Source: Bloomberg

Longer-term interest rates rose with the 10-year Treasury hitting a rate of 4.43% compared to a rate of 3.95% at the start of the year. Spending, tax cuts, and tariffs are thought of as fueling potential future inflation, and longer-term rates moved higher. Since bonds and interest rates move in opposite directions, it was a bad day for bonds with the Bloomberg Aggregate Bond index down about -0.75% on the day.

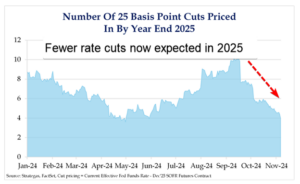

The market is pricing in fewer future cuts in short term rates. As I’m typing on 11/7, the Fed cut short term interest rates by 0.25%, taking the upper end of the Fed Funds Rate to 4.75%. As recently as September, the market was pricing in as many as 10 rate cuts by the end of 2025…now that number is 4. In other words, the market was pricing in the upper band of the Fed Funds rate to be 3% or lower in September, but today, expectations are pricing in an upper band of 4%. The market is clearly expecting fewer rate cuts after the election.

Source: Strategas

There is a lot to unpack as we shift from focusing on the emotion of politics to discerning the impact of policies on the economy and markets. We invite you (and any of your friends!) to our Portfolios at Your Place Zoom Event on Wednesday, November 13th at 4pm (you can register here). Joseph Group Chief Investment Officer Alex Durbin and I will talk about policy implications of the election, the outlook for various asset classes, and shifts our Investment Strategy Team is talking about making in portfolios as we respond to the changing investment landscape. This is a “don’t miss” discussion!

Written by Travis Upton, Partner and Chief Executive Officer