Talking Inflation and Real Estate Over Pastries and Coffee

September 3, 2021

To Inform:

Last week, Alex Durbin and I were privileged to facilitate a lively discussion at our Portfolios at Panera event. We covered a multitude of topics and in this issue of WealthNotes, we review the two key issues that generated the most discussion.

Inflation

Inflation is clearly a hot topic and something we as consumers are all experiencing in some way. On the other hand, the Federal Reserve supports the idea of inflation being “transitory,” meaning they believe inflation is not a long-term problem. Based on the mood in the room at Panera, investors seem to have more confidence in what they are seeing with food and gas prices than the Fed.

While we definitely have opinions, we want to focus on what the market is telling us and that is the inflation discussion is not as straight-forward as it may seem. Let’s look at both angles:

First, there are definitely reasons to be concerned about inflation. Wages are rising as companies struggle to find workers, rent prices are starting to increase, and higher inflation is becoming embedded in the psyche of consumers. According to expectations data from the Federal Reserve, consumers are expecting inflation to average over 3.6% for the next three years, up from about 2.5% prior to the pandemic.

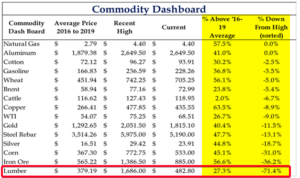

The table below shows the price changes for different commodities and, across the board, almost everything is up double digits today compared to the average price from 2016-2019. However, as shown in the column on the far right, most commodity prices have seen a meaningful correction from their recent highs a few months ago.

Source: Strategas Research Partners

To reinforce the last point, attendees at the Panera event found the picture below especially interesting. After soaring to over $1,670 per 1000 board feet in May, lumber prices today are closer to $500 per 1000 board feet, a -71% correction in a little over 3 months and much closer to their long-term average.

Source: 361 Capital

The correction in lumber is a good segue for the “inflation is transitory” case. In addition to the belief prices should come back down, we would say the Fed also believes inflation is not a long-term problem because the bond market is saying inflation is NOT a long term problem. The chart below illustrates the story:

The black dotted line shows the year over year change in the Consumer Price Index (CPI), and the recent spike to 5.4% is among the highest in the last 20 years. Higher food and energy prices contribute to this spike but so do things like used car prices (which are up over 35% year-over-year) which the Fed believes will ultimately roll over.

The red line shows the 10 year breakeven inflation rate based on the market for inflation-protected bonds. Currently, the bond market is pricing in inflation to average 2.36% for the next 10 years – elevated, but dramatically far away from the Fed’s 2.0% target.

Big picture, consumers are looking at the black line and saying inflation is a problem while the Fed is looking at the red line and is saying inflation is under control. Who is right? Historically, the bond market has the better track record. When it comes to investing successfully in the current environment, we want to be prepared whether inflation stays elevated or stabilizes at normal levels.

Source: Strategas Research Partners

Industrial Real Estate in Central Ohio

Another big topic was real estate, and specifically industrial real estate in Central Ohio. We discussed owning real estate investment trusts (REITs) across the various portfolios we have the privilege of managing for clients and how those REITs have not only been one of the best performing pieces of portfolios in 2021, but also how relative to stocks, REITs remain attractively valued.

The conversation moved to the local level and I mentioned, “here in Central Ohio, demand for logistics and warehouse space is so huge that we are seeing firms building spec warehouses before they even have tenants.” An attendee who works with an engineering firm in town (and is quite knowledgeable about the local market) replied, “yes, and they will have no trouble filling them.”

The Central Ohio market for industrial real estate is hot. According to real estate company JLL, industrial demand in Columbus grew 60.8% between 2020 and 2021. In a recent report, JLL named Columbus one of their “three markets to watch” (alongside Tampa, Florida and Savannah, Georgia) due to large spikes in demand. According to JLL Columbus’ Senior Managing Director Dan Wendorf (as told to Columbus Business First), “demand in Central, Ohio is spread out across multiple industries including e-commerce, fulfillment, retail, consumer products, food and beverage, automotive, and even high growth venture capital companies.” He goes on to say, “we’re definitely seeing levels of demand we’ve never seen before.”

The real estate discussion helped Portfolios at Panera end on a happy note. The strong demand across multiple industries bodes well not only for industrial real estate, but also for the jobs and housing markets here in Central Ohio.

One of the best parts about our live “Portfolios” events – whether it’s at Panera, Pints, or at Your Place – is participating in the discussion with other investors. We hope you can join us at an upcoming event.

Written by Travis Upton, Partner, CEO & Chief Investment Officer