The Good News and the Bad News

October 2, 2015

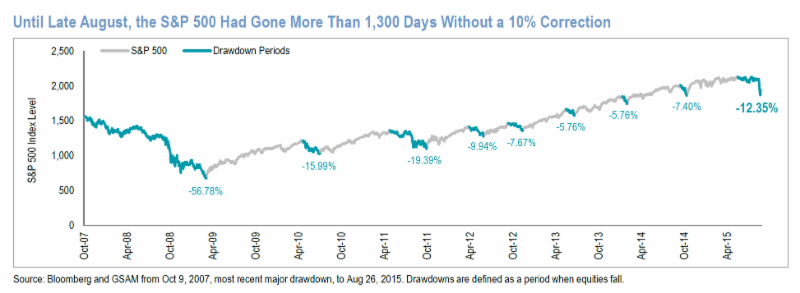

What’s the good news? As we have indicated in previous writings, corrections like this are normal. If anything, the fact that 2011 was the last time the market had a correction of more than 10% is rare in market history (see chart below). According to JP Morgan, based on the 35 years going back to 1980, the market had an average decline of 14% PER YEAR, but still had positive returns in 27 of those 35 calendar years.

Source: Goldman Sachs Asset Management

We also think it’s interesting to look at how similar the recent stock market correction is to certain other corrections we have seen in history.

- Fundamentally, the recent market correction looks a lot like what we experienced in 1998. That year, problems in Asia caused sharp declines in emerging markets and commodities and while the U.S. market hung in for a while, it ultimately experienced an 18% decline from July through early October. After bottoming in early October, the market then had a strong recovery in the 4th quarter the finish the year with a gain.

Source: Yahoo Finances, with additions by The Joseph Group

Source: Yahoo Finances, with additions by The Joseph Group

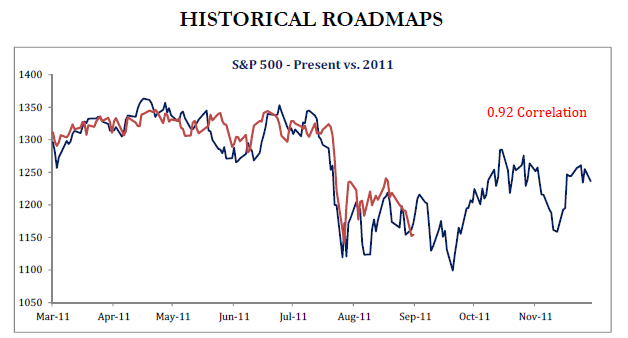

- Technically, the current market also looks A LOT like the decline which happened in 2011. Four years ago, the market experienced a sharp decline in August with the S&P declining 16%, then rallying 12% in the 4th quarter to finish the year with generally flat 2011 calendar year returns. (See chart below).

Source: Strategas Research Partners

The bottom line is that while we share investor concerns about weakening growth in China, history shows us we need to be prepared for a potential fourth quarter rally.

Clients of The Joseph Group will note they have seen a number of trade confirmations coming from Charles Schwab recently. Over the last few weeks, we have taken the following actions in client accounts:

- Tax Swaps: With major declines in energy/natural resource related stocks, we have gone into many of our taxable accounts to swap one fund for another to “book the loss” in order to offset capital gains and/or income for tax purposes. We are being diligent in using this correction as an opportunity to reduce our clients’ tax burden.

- Share Class Exchanges: Some clients may see a confirmation where it looks like we are buying and selling the same fund. That’s not the case! For clients that meet the requirements, we actively seek to move into “institutional class” fund shares on a regular basis in order to reduce investment expenses.

- Buying on the Dips: In an effort to prepare for the potential of a 4th quarter rally, we have been using down days in the market as an opportunity to add to stock exposure in certain client accounts. In late September, we slightly reduced our “Dynamic” exposure and increased “Global Stock” exposure in certain strategies, and will look for further opportunities to make more shifts in October.

As always, we welcome your questions and comments as we seek to navigate these crazy markets.

WealthNotes discusses general market activity, global, industry, or sector trends, or other broad-based economic, market, or political conditions and should not be construed as research or investment advice. Views and opinions are for informational purposes only and do not constitute a recommendation by The Joseph Group to buy, sell, or hold any security or asset class. Views and opinions are current as of the date of this publication and may be subject to change without notice.