The Magnificent Metal

April 12, 2024

To Inform:

Last year one of the biggest stories in markets was the performance of what was dubbed the “Magnificent Seven.” These stocks, largely technology related, surged higher on better earnings and hope for an end to the Fed’s hiking cycle. This year, these companies are a bit of a mixed bag, as cracks appear in places like the electric vehicle market and the demand for smart phones. An investment almost no one was talking about last year, and few seem to be doing this year is gold. Gold’s performance over the last several months should earn it a magnificent moniker. As I write this on April 12, gold is currently sitting at a price of nearly $2400/oz, more than 30% higher than as recently as last October.

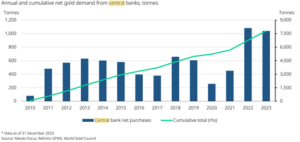

You may ask yourself, “well, how did gold get here?” The answer, to borrow a line from a Talking Heads song, is in one sense the “same as it ever was” but in another sense, quite curious. Let’s start with the most salient answer – demand for gold. Jewelry consumption, industrial and medical uses, and investment purchases account for the demand for gold. One big driver of demand that has accelerated in the last couple of years is the increase in central bank purchases of gold, as seen in the charts below. As you can see purchases really began to ramp in 2022 and in only a handful of months in the last couple of years saw central banks selling more gold than buying.

Source: World Gold Council

Central banks, when surveyed, express some of the same reasons individuals do as to why they prefer holding gold. Among them are gold’s performance during times of crisis, its role as a long-term store of value, and a way to diversify portfolios.

Another tailwind for the rise in gold prices, at least in late 2023, was the decline in interest rates and a weaker dollar. Gold tends to do well when interest rates are falling and the dollar is weakening. The US dollar’s high relative to other currencies was at the beginning of last October when gold was at its 2023 low. The dollar went on to weaken by about 5% through the end of the year before rebounding this year by a similar amount.

Interest rates moved markedly lower in the fourth quarter of 2023, with “real rates” (current interest rates minus inflation expectations) moving down from around 2.1% to 1.6% before rebounding this month to around 2% again. History would argue that these moves are bad for gold prices, yet the “magnificent metal” is up over 15% since the beginning of March.

When the market gives us such divergent stories, our interest is piqued. It is especially so when the investment in question is one that is held in many client portfolios we have the privilege of managing. What might explain the fact that gold is overcoming serious headwinds in rising rates and a rising dollar? We think the best explanation is the original one – that investor demand is overwhelming the impact of higher rates and a stronger dollar. For as long as geopolitical risks don’t seem to be going away and long-term inflation expectations creep higher, investors around the globe are likely to value portfolio diversifiers like gold.

Written by Alex Durbin, Chief Investment Officer