The Mailbag – Bonds, Stock Market Rally, and Recession Watch

August 25, 2023

To Inform:

It’s been a few months since we’ve done this, but I think now is another good time to dust off the mailbag and answer a few questions we are hearing from clients. Hopefully this encourages you to think of any questions you may have and send them our way. Without any further ado, let’s jump in.

“Is now a good time to buy bonds?”

A client and long-time friend of the firm recently asked us this, and it is one TJG’s Investment Committee seems to debate on a regular basis. Why is it that with bond yields at levels we haven’t seen since the 2000s we aren’t “backing up the truck” to buy bonds? Two reasons. One, we think there are a number of catalysts on the horizon that could push bond yields even higher. Chief among them is the supply and demand for treasury bonds. As the US continues to run substantial budget deficits, the Treasury is flooding the market with more supply of Treasury bonds. This is happening just as the biggest buyers for these bonds – the Federal Reserve and foreign countries – are stopping or reducing their purchases. The chart below indicates the change in Japanese and Chinese holdings of Treasury bonds over the last 15 years. The trend is clearly down. With the Federal Reserve also selling bonds to reduce their balance sheet and foreign buyers stepping away it is possible that the market demands higher yields to soak up all of the coming supply. The other reason we haven’t gotten overly aggressive here is that we believe we have some interesting tools in our toolbox that we didn’t have 15 years ago. These tools allow us to position client portfolios to have a reasonable chance of achieving their objectives without taking the risk that is posed by any higher moves in interest rates.

Source: Strategas

“Will this year’s rally in US stocks continue?”

TJG CEO and Chief Investment Officer Travis Upton focused on this question in our recent Portfolios at Your Place Zoom call. It may be surprising to some, but this year’s move higher in stocks has come not from an increase in earnings, but an increase in what investors have been willing to pay for those earnings as the chart below indicates. Earnings forecasts for the year ahead have steadily fallen throughout 2023, but the S&P 500 Index has continued to rise. We’ve seen this before, and our hunch is that while the second half of 2023 could indeed be positive for investors in stocks, the likelihood of a repeat of the first half when stocks were up in the high teens is quite low. We think the market has pulled forward a lot of the gains for this year, and it would take a tremendous resurgence in earnings growth to move stocks significantly higher. We think the more likely scenario is a grind higher in stocks should economic news continue to come in that indicates no recession. One of our favorite tools for such an environment that we use in a number of client portfolios we have the privilege of managing are hedged equity funds. The premise is quite simple. These funds use options to protect investors from a material move down (think greater than 5%) while retaining some exposure to rising markets.

Source: Strategas

“Will there be a recession?”

If you had asked us this last fall, or even at the end of 2022, we would have said there was a pretty decent chance for a mild recession to materialize sometime in 2023. So would a number of economists. A survey of economists predicting recession sometime in the next 12 months hit record highs last year, but a recession failed to materialize. Were they (and us) wrong or just early? It’s possible it is the latter. Indeed, a number of indicators that historically have been quite reliable in predicting recession have been flashing red in recent months. One of them is the Conference Board’s Index of Leading Economic Indicators.

Source: Strategas

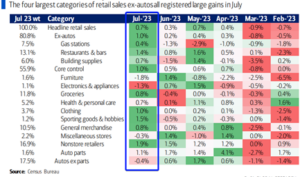

While this indicator and others, like the shape of the yield curve, have been caution signals, other things tell us that the economy still seems to be in pretty decent shape. One recent data point supporting this idea is the July 2023 retail sales report. Retail sales in a number of categories were strong, and significantly better than readings from earlier in the year. Our view is that as long as the consumer behavior remains strong and employment growth steady, recession is not imminent.

Source: BofA Global Research

Hopefully this mailbag answered questions you may have or got you thinking about things a little differently. As always, we love to hear what is on your mind so please reach out to any of us here with things you may be wondering about. Perhaps it gets tossed in mix of questions Travis Upton and I will try to answer at next month’s Portfolios & Pints!

Written by Alex Durbin, CFA, Portfolio Manager