The Mailbag – The Dollar, Dividends, and the Debt Ceiling

April 14, 2023

To Inform:

Instead of pontificating about topics I think will be interesting to our readers (I hope we’re doing a good job at this!), I thought it would be worth addressing a few questions that seem to be on the minds of lots of friends and clients. So read along for a rapid fire Q&A. Hopefully you’ll find this informative and be encouraged to send additional questions our way if you’ve got them.

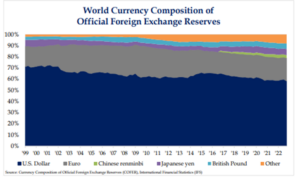

“What is going to happen to the US Dollar? Will it lose its reserve currency status?”

Believe it or not, that is one of the biggest questions we seem to be getting these days. And for good reason. One can’t help but notice the unipolar world ushered in by the collapse of the Soviet Union seems to be fading away. In that unipolar world, the dollar was dominant, challenged only by the Euro for reserve currency status. Today’s world, however, seems to be fracturing. China, Russia, and India, along with a host of smaller states, have begun to look for alternatives to dollar denominated trading activity, especially with respect to trade in energy commodities. Is this a harbinger of more to come?

While the dollar has indeed been challenged and has slowly lost share against other currencies in global foreign reserves, it remains the most important currency in global trade. One of the research firms we use and have tremendous respect for, Strategas, noted in a recent piece that turnover in global currency amounts to $7.5 trillion (yes, with a t!) daily. The dollar is on one side of 88% of those transactions, down from 90% in 1988.

Source: Strategas

While we believe the dollar is not in imminent danger of losing reserve currency status, a failure to “live within our means” represents the greatest threat to the dollar. With $31 trillion in debt, half of which comes due in the next 3 years, the United States needs to get serious about getting its fiscal house in order. While many other countries carry similarly high debt loads, losing our status as “cleanest shirt in the dirty clothes hamper” could very well sow the seeds of future dollar weakness. What would we favor in such an environment? International stocks (developed and emerging markets) and commodities would likely be beneficiaries of sustained dollar weakness/loss of reserve currency status.

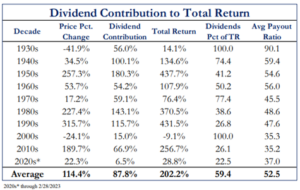

“What if the market just doesn’t go anywhere? How do I make money?”

If you’ve read these notes or listened to us speak, you’ll know for investors in stocks there are three ways to make money. Earnings growth, multiple expansion (what investors are willing to pay for earnings), and dividends all comprise “total return.” As we begin to kick off Q1 earnings season, most market watchers are predicting a slight decline in earnings on a year-over-year basis. That’s strike one. Multiple expansion is more likely in an environment of falling interest rates or very low inflation. While we may be near a peak in rates and inflation is coming down, conditions are not ripe for an expansion in multiples. Strike two. That leaves us with dividends.

While underperforming so far this year, dividend payers as a group are attractive to us, especially in a “wait and see” environment like the one we’re currently in. As big fans of history, we find it interesting that in every decade since the 1930s dividends have contributed positively to total return in stocks. While that may sound like stating the obvious, it is a point worth noting. In some decades, dividends are a fraction of total return. In others, they comprise a majority or even all of that decade’s total return in stocks. The table below breaks this down for us. While our crystal ball is too murky to forecast what price percentage change will look like this decade, our money is on dividends comprising a greater component of total return than it did in the 2010s. In portfolios we have the privilege of managing for clients dividends are an important factor in stock and mutual fund selection.

Source: Strategas

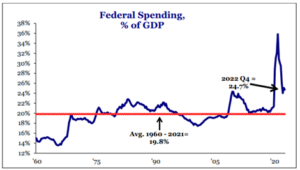

What’s going on with the debt ceiling?

Lately, very little. But that is set to change. As Tax Day nears a final fillip to the Treasury’s coffers will take place. From there, the clock starts ticking. Tax revenues will help determine when exactly the “X” date is. Right now estimates are for the debt ceiling to be reached sometime in July or August. As soon as next week, horse trading is set to begin in earnest, with House Speaker Kevin McCarthy’s speech to the NY Stock Exchange. There, McCarthy is likely to detail the GOP’s budgetary demands in order to approve an increase in the debt ceiling.

While concessions will likely need to be made on both sides, a case can be made for spending cuts. Federal spending as a percentage of GDP spiked to over 1/3rd of GDP during the COVID shock, but still hovers at close to 25%, well above the long-term average of 20%. There are some low hanging fruit Republicans are likely to ask for including: ending student loan deferral, eliminating student loan debt forgiveness, and ending unobligated COVID-19 spending. These measures alone could free up close to a half trillion dollars.

Source: Strategas

Time will only tell but expect much more news on this over the coming weeks and months. It is in everyone’s best interest that negotiations lead to a deal sooner rather than later. Brinkmanship will be costly and is already proving so, as the cost of insurance for US government bonds has reached levels not seen since the last debt ceiling fight in 2011.

Source: Financial Times

Hopefully you found something of interest in this week’s “mailbag.” We love fielding questions, so if you’ve got any pressing ones don’t hesitate to reach out. Who knows, maybe your question will show up in the next mailbag!

Written by Alex Durbin, Portfolio Manager