The Market Says – “Give Me Rate Cuts!

July 12, 2019

To Inform:

One question I (Travis) get often from people who know what line of work I’m in is “what’s driving the market?” The financial certifications I studied years ago would suggest the answer to that question should be corporate earnings, cash flows, valuations, and economic growth. Lately though, the conversations seem to gravitate toward politics, trade wars, and the Federal Reserve.

The last few weeks, the Federal Reserve and the likelihood the Fed will cut short term interest rates this year are front and center.

First a little history lesson – let’s go all the way back to December, 2018 (7 months ago). Economic data was strong and in December, Jerome Powell and the Fed increased short-term interest rates with expectations they would continue to increase rates, with potentially as many as 3-4 hikes in 2019 (this year) as a way to keep the economy from overheating. The market reaction was not good and the S&P 500 was down about -9% in December 2018.

Fast forward to today – economic data is weaker, earnings growth estimates are lower, and the Fed has reversed course. Interest rate hikes are off the table and the possibility of rate cuts is dominating discussions. And it’s not just whether the Fed will cut rates this year, it’s how many times.

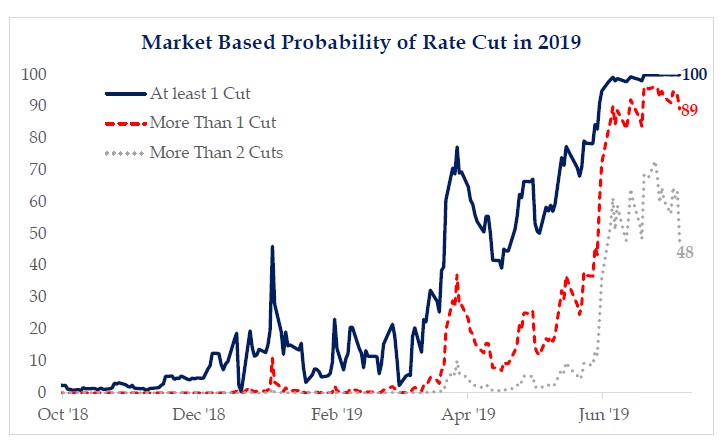

The chart below gives a good picture of what is happening.

Source: Strategas Research Partners

Source: Strategas Research Partners

The chart reflects the market-based probabilities of the Federal Reserve cutting rates this year and here is a summary of what it is saying:

- – The blue line shows the market is now pricing in 100% odds of a cut this year, and unless there is a major surprise it likely happens at the Fed’s next meeting on July 31.

- – The red line shows the probability of more than one rate cut this year (which we read as two). The market is pricing in 89% odds that the Fed cuts rates more than once. Those odds jumped dramatically in June after increased tariff discussions in May clouded the economic outlook.

- – The gray line shows the probability of more than 2 (three) rate cuts this year. Those odds, currently 48% (so a virtual coin toss) were essentially zero at the beginning of June. One interesting tidbit – at the beginning of July, you can see the gray line hook down from the 60-70% probability level to the current 48% level. Why did the line move down? The June jobs number came in with 224,000 new jobs created – much stronger than expectations. The economic data was good, so the Fed might not need to cut rates to stimulate the economy as much…and it is worth noting stocks were down in light of the jobs announcement.

So, back to the question – what’s driving the market lately? The last few weeks, the stock market has been highly correlated with the probability of rate cuts – when the probability of Fed rate cuts goes up, so does the market and vice versa. The Fed’s next meeting is July 31st, which happens to be my birthday! I think I’m going to be charitable and ask for a rate cut because based on the market’s behavior, no one wants a surprise from Fed Chairman Jerome Powell.