The One Big, Beautiful Bill and Tyrannosaurus Debt

July 11, 2025

To Inform:

“We’ve got to feed the monster, so it doesn’t get upset, it’s got an awesome appetite, Tyrannosaurus Debt.” For schoolchildren of a certain age “Schoolhouse Rock” was one’s earliest lessons in civics. “Tyrannosaurus Debt” was one of a long list of video vignettes set to jocular music about topics that were a lot heavier than the music implied. In Tyrannosaurus Debt the singer rues the challenge in 1996 of dealing with a debt burden of $5 trillion in the US. Today, according to the US Debt Clock, that number stands at $37 trillion and rising.

We get many questions about the state of America’s finances and what that might mean for markets. With last week’s signing of the “One Big Beautiful Bill” or OBBB for short these questions have picked up.

First and foremost, the OBBB preserved the individual tax brackets that were reduced in 2018 that had been set to increase in 2026. The standard deduction which was increased significantly in 2017 was also preserved. Seniors will receive an added deduction that phases out at $75,000 for individuals and $150,000 for couples. The State and Local Income Tax (SALT) deduction will rise from $10,000 to $40,000. Other features of the bill include tax credits for companies expanding manufacturing in the US, increased defense spending, and additional resources for immigration enforcement.

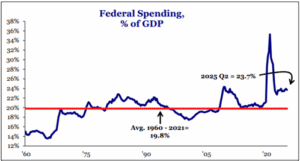

To borrow a phrase from earlier Wealthnotes, this is a lot of candy. Despite cuts to clean energy credits and a slowing of Medicaid spending growth over current baselines, the Congressional Budget Office estimates that the OBBB will cost $3.4 trillion over the next decade. That’s a lot of food for the Tyrannosaurus Debt! The chart from Strategas below illustrates the percentage of GDP that is comprised of federal spending.

Source: Strategas

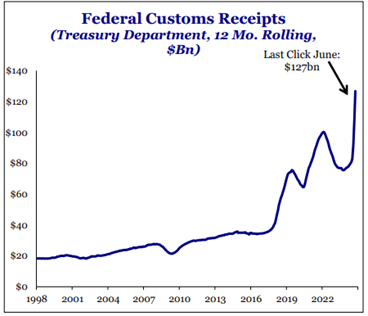

There’s some better news tucked away behind the headlines, however. When it comes to budget projections, there is some nuance between the concept of “current law” and “current policy.” The projection of $3.4 trillion in costs is based on “current law.” Tariffs, a major source of new government revenue are not enshrined in law. The Congressional Budget Office cannot therefore include these revenues in their projections of the OBBB using the current law approach. They can use them in their current policy approach. When doing so, the estimated cost of the OBBB when considering tariff revenues over the next decade shrinks to about $400 billion. A large number, yes, but more of an appetizer for Tyrannosaurus Debt than a full course dinner.

Source: Strategas

We think it is likely that debt levels in the US continue to grow, but at a rate that doesn’t spark a debt market crisis in the US.

The effect on markets is what we’re most interested in. Interest rates will move around going forward, but investors more likely than not will demand a higher rate of interest given the amount of supply of US debt being issued. While this means a great bull market for bonds like the one experienced from the early 1980s until 2021 is unlikely, the reality is that bond yields are much higher than they were last decade.

Assets we find interesting going forward are ones that are scarce. The government of course can’t issue more gold or natural resources like they can bonds. Nor can they issue more claims on the earnings streams of good businesses (i.e. stocks). While we do have a Tyrannosaurus Debt stalking the halls of Congress, the OBBB isn’t likely to change his demeanor or increase his size. Would we like it if the Tyrannosaurus Debt was just a fossil in D.C.? Of course! That said, we don’t think his existence threatens the ability to meet the long-term return targets built into financial plans.

Written by Alex Durbin, CFA, Chief Investment Officer