The Return of the Bond Vigilantes

October 13, 2023

To Inform:

Dr. Ed Yardeni, a fixture on Wall Street for decades, is credited with coining the phrase “bond vigilante” in 1983. Bill Clinton’s political adviser James Carville said in 1994 that if he could be reincarnated it wouldn’t be as president, or the pope, or a .400 baseball hitter, but as the bond market because, “you can intimidate everybody.”

What is a bond vigilante and why did James Carville want to be one? Simply put, bond vigilantes are investors who sell or avoid purchasing government bonds as a means of voicing displeasure with fiscal or monetary policy. The only thing that will placate them is higher bond yields or a change in the path of fiscal or monetary direction.

Bond vigilantes make their appearance in periods of high inflation (the early 1980s), high government deficits (the early 1990s) or both (now). The episode in the 1990s is akin to what we’re seeing today. In 1993, budget deficits as a percentage of GDP were near post-war highs at close to 4%. Deficits eclipsed this level in the 1980s, but bond yields were higher by several percentage points then. Rates on 10-year government bonds were as low as 5.2% in October of 1993. By November of 1994, after the vigilantes sacked D.C., rates peaked at over 8%. Congressional elections that year saw a return of divided government and greater fiscal discipline, and the bond left town with 10-year bond rates falling below 6% by the end of 1995.

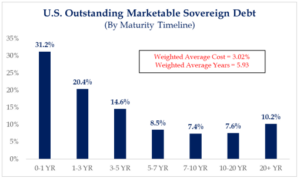

Looking at these numbers is almost quaint. Deficits as a percentage of GDP in recent years have exceeded 10% in two of the last four years (2020 and 2021) and have exceeded 5% or are projected to do so in the other two years (2022 and 2023). Deficits have exceeded 5% in only eight of the last ninety-five years, with five of those being in the period around World War II. With deficits like these and a wide swathe of US government debt maturing in the next 3 years, it is a safe bet to say the bond vigilantes are back. In the midst of an episode of vigilantism, the rates on 10-year and 30-year government bonds have reached sixteen-year highs.

Source: Strategas

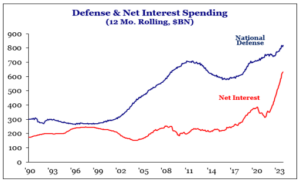

What does this mean for investors? One key takeaway is that bond yields are not likely to fall back to levels seen in the past decade for as long as the U.S. government is running such large deficits. That said, when the impact of these higher rates begins to weigh on the federal budget (something you can see is already happening in the chart below) it is only a matter of time before Congress and the White House are forced to act. These actions historically have called off the marauding bands of bond vigilantes and result in lower bond yields. For investors with the stomach to buy bonds when rates have been going up and bond prices have been going down (remember the see-saw like inverse relationship here) the prospect for strong forward returns for bonds should yields eventually decline is very good.

Source: Strategas

That said, one unfortunate aspect of this battle between the bond vigilantes and those in charge of the Federal purse is that the negotiated piece often involves compromise. For one side of the aisle that may be a reduction in spending programs. For the other, it might mean an increase in taxes. If the latter occurs (a strong prospect in the next several years) one practical piece of advice is to discuss with your advisor the merits of Roth IRA conversions. While this incurs a tax liability in the year of conversion, if your view is that taxes are going to be higher in the future it can make a good deal of sense to pay the taxes now and avoid them at higher rates down the road.

Paraphrasing one of my favorite authors I’ll say I wish bond yields hadn’t moved this high this fast (remembering the see-saw relationship again). But that isn’t for investors to decide. All we have to decide is what to do with the opportunities these yields present us!

Written by Alex Durbin, CFA, Portfolio Manager