The “Right Portfolio”

June 19, 2020

To Inform:

“There is no one right portfolio, but there is one that is right for you.” This quote from author Larry Swedroe is worth remembering, especially when markets are experiencing bouts of volatility. Our holistic approach of weaving your portfolio, plan, and purpose together as a cohesive roadmap to financial security acknowledges this principle. It’s why we’ve put together our objectives-based portfolios and is a guiding principle in how we manage them.

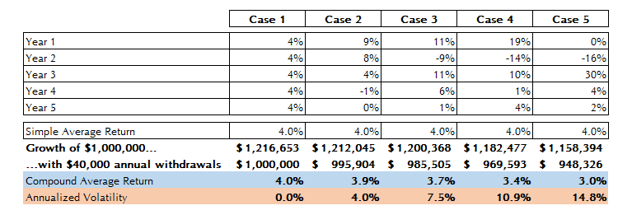

For example, our Provision portfolio is designed to focus on current income and low volatility of returns. For the person who needs income from their investment assets, this could be their “right portfolio”. With that in mind, our goal is to make sure the portfolio can actually deliver on that objective. While we seek out current income, one important factor in our ability to do this is to limit the volatility of returns. The reason for this is the effect high volatility has on compound returns – the higher the volatility, the lower the compound return. The scenarios below all show simple average returns over five years of 4%. In each case, however, 4% of the portfolio is being withdrawn annually. As we move from Case 1 to Case 5 volatility is increased even though the simple average of returns remains 4%. Notice how ending values decrease and compounded returns decline as volatility increases? The ride matters when one is drawing income from their portfolio.

When tested by volatile markets it is easy to get nervous and be shaken from your convictions. When those situations present themselves it may be helpful to ask, “is my portfolio going to be permanently impaired from doing what it’s designed to do?” In the case of Provision we saw such a test in March. Considerable uncertainty was impacting nearly all asset classes. That being said, was it likely dividend income and bond interest would completely dry up, permanently? We didn’t think so, and our long-term thinking that guides the construction of our Provision portfolio didn’t change.

Sticking to the objectives and the purpose of a portfolio when times get tough is critical for achieving one’s desired long-term outcomes. Our crystal ball is only so clear in showing us how things unfold the rest of the year, but we do have conviction in our belief that financial assets will continue to generate income and, if you look in the right places, can do so with minimal volatility. For the clients whose “right portfolio” is one that generates sustainable income, we would encourage you to filter ideas and market headlines through that lens. Doing so may give you peace of mind, even when things turn choppy. This is important because your purpose is too important to lose sleep over your portfolio!

Everything we do is rooted in our values and designed to help our clients live their best life with minimal worry about investments. Reach out to us anytime with questions, and keep living your great life!

This WealthNotes Inspire was written by Alex Durbin, TJG Portfolio Manager

This WealthNotes Inspire was written by Alex Durbin, TJG Portfolio Manager