The Stimulus Keeps on Coming

April 1, 2021

To Inform:

President Biden released his infrastructure proposal earlier this week. Let’s review some of the facts and share thoughts about how further stimulus may impact markets.

The White House proposed spending about $2.2 trillion (with a T) over the next 10 years. The spending consists of $1.7 trillion in investment in physical infrastructure with another $500 billion going to workforce incentives and Medicaid benefits. According to research from Goldman Sachs, here is how the infrastructure piece breaks down:

- $560 billion for traditional heavy infrastructure Traditional heavy infrastructure includes highways, bridges, ports, and water/sewer projects.

- $375 billion for technology infrastructure. This includes broadband, electrical grid modernization, clean energy and storage, and electric vehicle-related spending. One statistic which caught our eye is the goal of 500,000 electric vehicle charging stations. 500,000 is only about half the population of Columbus, Ohio but it’s interesting to think about how those charging stations may impact our day to day life.

- $375 billion for building and upgrade of residential and non-residential structures such as schools and housing for disabled and elderly individuals.

- $480 billion for research and development and manufacturing incentives.

Another proposal is expected to come later this year. It is worth noting the White House has indicated the President will announce a second proposal (in April?) dealing with “human infrastructure” which refers to spending on child care, health care, and education. In other words, the stimulus keeps on coming. Ultimately though, it is up to Congress to pass the proposals and whether they decide to consider the proposals separately or combine them remains to be seen.

Paying for it – tax Increases. According to the Biden Administration, the 10-year cost of the current proposal would be paid for after 15 years through tax increases, largely in the corporate sector. Here are the highlights of the proposal to pay for it:

- Increase the U.S. corporate tax rate from its current 21% rate to 28%. The U.S. corporate tax rate was cut from 35% to 21% under President Trump, so the proposal would only reverse a portion of those cuts. However, at 28%, the integrated corporate tax rate on corporate taxes distributed as dividends would be one of the highest in the world which is one reason the proposal may run into resistance. We’re seeing estimates that a compromise in Congress might result in a final corporate tax rate in the 24% to 26% range.

- Increase the minimum tax on U.S. multinational income from overseas from 10% to 21%. This one is significant because changes associated with the increase are expected to impact most companies which have any foreign income.

- Impose a 15% minimum tax on corporate book income reported to investors. The key here is addressing a situation where companies report profits to shareholders, but no profits to the IRS. This can happen when a company makes large capital investments where there is depreciation for tax purposes.

Tax increases for individuals are NOT part of the current proposal, but are likely coming. The current proposal only deals with corporate taxes. Items such as increasing the top bracket for individuals, increasing the long-term capital gains rate, and reducing the estate tax exemption were not part of the current proposal but are still expected to come later this year.

Considerations for the impact. Markets are going to be digesting the current proposal and so are we. Here are a few important considerations The Joseph Group’s Investment Strategy Team is focused on.

- We are seeing lots of research suggesting infrastructure spending operates with a lag. From an impact perspective, let’s say infrastructure spending takes 18 months to ramp up, but tax increases hit immediately. We may see a hit to corporate profits from tax increases in 2022 but not truly start to see revenues from projects start to happen until 2023.

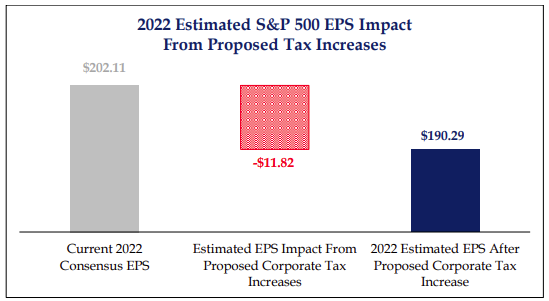

- Growth to earnings is still expected to be positive in 2022. Strategas Research Partners conducted a rough analysis based on preliminary information which is shown in the charts below.

Analysts expect corporate earnings to come in at $202.11 per share in 2022. The proposed corporate tax increases are estimated to shave $11.82 from that number, resulting in a $190.29 estimated earnings number.

Source: Strategas Research Partners

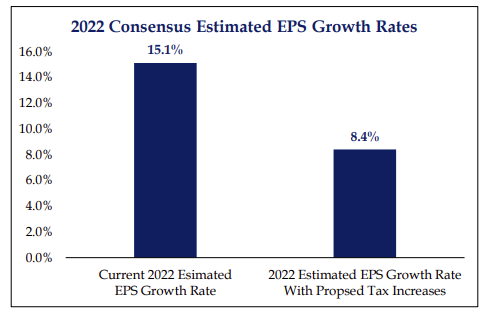

The bad news is a lower earnings number results in a higher price to earnings (P/E) ratio, which in turn implies higher valuations for stocks. The good news is even with lower forecast earnings, the earnings growth rate is still strong – the growth rate is expected to decline from 15.1% to 8.4%.

Source: Strategas Research Partners

- Higher corporate tax rates are negative for the U.S. dollar, all else equal. When corporate taxes were cut in 2017, the U.S. dollar strengthened, and U.S. assets largely outperformed foreign assets. Higher corporate taxes and less repatriation of foreign cash are generally dollar negative, which would tend to support foreign stocks and bonds over U.S. assets.

There is a ton of stimulus in the pipeline for 2021. Between payments to individuals and tax refunds, the U.S. Treasury is estimated to have distributed over $422 billion of payments to consumers in the month of March alone. AND this is money that is hitting as economies are opening as vaccines become more widely available. We expect economic data to look amazing in the months ahead as more consumers spend money and industries such a restaurants and tourism hire more people. Anecdotally, I had two separate conversations of people looking to book cruises today. Between vacations, dining out, and people getting back to the office, re-opening is looking massive.

The infrastructure stimulus package proposed this week and the human infrastructure proposal expected to come next month are much longer term in nature and have costs, such as tax increases, which will create winners and losers. From a market standpoint, we are expecting more volatility as markets digest tax increases and higher interest rates, but the growth backdrop surrounding it all is significant.

Written by Travis Upton, Partner, CEO and Chief Investment Officer