The Value of Moats and Not Overpaying for Them

February 21, 2025

To Inform:

Warren Buffett, the famed value investor from Omaha, began writing about “economic moats” back in the 1980s. Similar to a castle, the idea of an economic moat is something that protects the company from threats. Put another way, a moat is the source(s) of a company’s competitive edge, that will allow it to outperform competitors and reward shareholders.

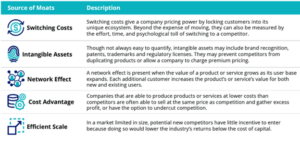

Morningstar, a financial research provider, took Buffett’s ideas and distilled them into 5 key concepts: switching costs, intangible assets, network effects, cost advantages, and efficient scale.

Source: Morningstar

These terms might sound academic, but in reading the descriptions you can probably think of some companies that have these characteristics. Think of a payment processor accepted by retailers around the world. That’s a network effect. Or a giant retailer that has great pricing power. That’s a cost advantage.

We’ve often said that great companies aren’t always great stocks. Sometimes, a company’s stock can be priced for perfection. There are companies with great, wide economic moats that are just really expensive! Buffett and his love for value would tell you to avoid overpaying for moats. Think of some of the high-flying technology names from the late 1990s that are still around today. During the Tech Bubble collapse many of these stocks were down significantly, despite steady operating results from these wide moat companies. Some of them took more than a decade to recoup their losses.

A winning combination, we think, is to find good, wide moat companies with decent valuations. This is a philosophy that we seek to employ in our process for identifying stocks in the Home Grown portfolios we have the privilege of managing on behalf of clients. While not a free lunch, we think there is tremendous staying power to finding great businesses that trade at reasonable prices. It won’t always be the toast of the town, but history and the success of investors like Warren Buffett tells us it has staying power!

Written by Alex Durbin, CFA, Chief Investment Officer