The World May Not Be Flat, But Earnings Are

July 26, 2019

To Inform:

The stock market is currently in the midst of quarterly earnings season. As of July 25th, 61 companies within the S&P 500 are reporting their earnings for the 2nd quarter, and next week, 160 companies are reporting.

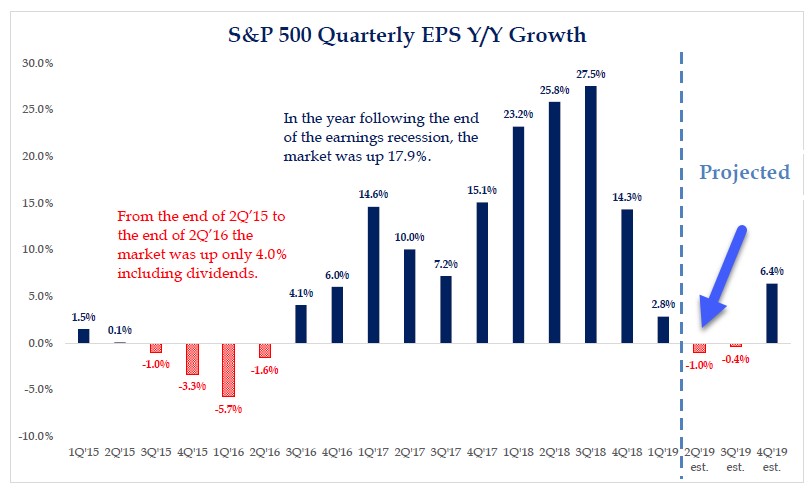

So, with the stock market hovering around record highs, earnings growth for U.S. companies must be pretty robust, right? Not exactly…with a few weeks to go in the 2nd quarter earnings season, the current projection for the year over year growth in corporate earnings is -1.0% (blue arrow in chart). It is worth noting, earnings are also expected to contract slightly next quarter before resuming an upward growth trajectory at the end of this year.

Source: Strategas Research Partners

Source: Strategas Research Partners

One of the biggest questions we are getting from clients, is “if earnings are not growing, why is the market doing so well?” We would answer that question in two ways:

First, most of the return from the S&P 500 this year has come from “multiple expansion,” a fancy term for higher prices. For 2019, analysts estimate the companies in the S&P 500 will earn about $166 dollars per share. At a current level of 3,006, it implies the Price to Earnings (P/E) ratio for the S&P 500 is (3,006 / 166 = ) 18.1x. At the beginning of the year the P/E number was closer to 15x, so we’ve seen a big increase in the multiple investors are willing to pay for stocks. Lower interest rates tend to support higher multiples, so the decline in interest rates the market has experienced this year could have a lot to do with the multiple expansion.

Second, investors are looking more at what they think earnings will do in the future more than what earnings are today. With interest rate cuts on the horizon and hopes for a trade deal between the U.S. and China, investors seem to believe earnings growth will pick up again in the future. Analyst estimates for 2020 currently project earnings to come in at around $184 per share, about 11% higher than where they sit today.

With multiple expansion (rising P/E ratios) driving the most of market’s returns this year, we think it is a fair statement that there is a lot of hope baked into the market right now. There is hope for interest rate cuts next week, hope for a trade deal, and hope earnings growth will pick up in the months ahead.

Have a great week!