There Is A Disconnect Between the Way Main Street and Wall Street Views the Impact of the Election

October 15, 2020

To Inform:

Virtually every conversation I have about financial markets lately involves the upcoming Presidential election. That’s no surprise as the prospect for shifts in economic and tax policies after the election is significant regardless of which candidate is your favorite. I will say though, there seems to be a disconnect between the way “Main Street” is viewing the market impact of the election and the way Wall Street is viewing it.

“Main Street,” a term we will use to describe individual investors, widely believes the potential for volatility, if not a market plunge, in a few weeks is significant. The idea we may get a contested election, sweeping changes in tax policy, or riots in the streets has many individual investors convinced a financial market storm is just around the corner.

“Wall Street,” a term we will use to describe the big investment banks and research firms, don’t see it that way. Here are a few examples from recent reports:

-

JPMorgan’s Global Asset Allocation Group recently increased their overweight to stocks and reduced exposure to fixed income. According to JPMorgan in an October 8th report, “even if the U.S. election result proves to be too close or contested, resulting to a new bout of uncertainty next month, it would not, in our opinion derail an upward medium to longer term trajectory for risk assets.”

-

Goldman Sachs Asset Management maintains their 3- and 12-month price targets for the S&P 500 of 3600 and 3800 respectively (compared to a level as I type of 3490), implying further upside for stocks. Regardless of your politics, one view is that higher taxes coming from a Biden presidency would be negative for stocks. Goldman differs in their view. In an October 5th report, Goldman states, “…a blue wave (meaning Democratic sweep) would likely prompt us to raise our forecasts. The reason is that it would sharply raise the probability of a fiscal stimulus package of at least $2 trillion shortly after the presidential inauguration on January 20th, followed by longer-term spending increases on infrastructure, climate, health care and education that would at least match the likely longer-term tax increases on corporations and upper income earners.”

-

Strategas Research Partners, an independent research firm, has been pointing to a recent broadening out of market leadership. In an October 12 report, Strategas Technical Analyst Chris Verrone said, “75% of S&P 500 constituents are trading above their respective 200-day moving average, the best reading of the recovery and suggestive of a broadening opportunity set…we’d fight the temptation to let the headlines dictate the strategic call – election or no election, COVID or no COVID, stimulus or no stimulus, stocks remain on firm ground.”

So, while many individual investors are getting more cautious, Wall Street is getting more optimistic. Who’s right? We’ll only know for sure a few weeks from now, but there are a few factors we believe support looking past the election:

First, markets hate surprises. Markets move daily and minor corrections can happen anytime (we had a 10% correction in the S&P 500 last month). The big sharp moves which investors are understandably concerned about tend to happen when the market is surprised by something (take a global pandemic for example). The chart below shows that a U.S. Policy Uncertainty index is at a level far higher than around previous elections. We also note options pricing has been pricing in higher volatility in November. In other words, the uncertainty is the certainty everyone is already talking about. It’s not a surprise.

Source: Capital Group, www.policyuncertainty.com

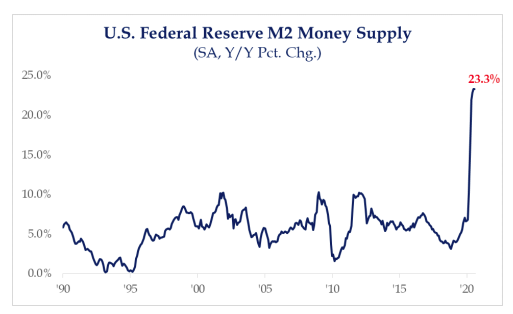

Second, as powerful as a President Trump or a President Biden may be, the most powerful person when it comes to markets may be Fed Chair Jerome Powell. Regardless of who is President, Powell and the Fed are likely to keep interest rates low and continue to provide monetary support and stimulus to the market. Investors may want to fight Biden or Trump, but don’t fight the Fed has historically proven to be good advice for investors. The chart below shows the year over year growth in the money supply…for investors, Strategas quipped, “this may be all you need to know” as a rising money supply means a supportive backdrop for stocks.

Source: Strategas Research Partners

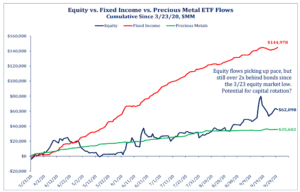

Third, for as much as stocks have rallied, fund flows into stocks are not extreme. Since the market lows on March 23, over twice as much money has flowed into bond ETFs (with rates near record lows) as it has into stock ETFs. Whether you look at fund flows, cash on the sidelines, short interest, or other factors, there is a lot of caution already out in the marketplace.

Source: Strategas Research Partners

While we may have our own personal views on the election, our job is to be unemotional when our clients are emotional and to apply logic to our client’s investment portfolios and financial plans. We aren’t going to pretend to know what may happen on election night a few weeks from now. What we do know is the portfolios we manage and the financial plans we help create are tools to support our clients’ purpose. In some portfolios, caution may be the right decision in case a “Main Street” scenario plays out while in other portfolios, we may want to position things more in line with “Wall Street.” Regardless of which candidate is declared the President after November 3rd, our job is to make sure our clients are in a position to “win” even if their preferred candidate does not.

This WealthNotes Inform was written by Travis Upton, Partner, CEO and Chief Investment Officer