Think Different

January 23, 2026

To Inform:

On the ropes in the 1990s, Apple was casting about for a slogan to power a marketing campaign. “We’re back” was tried, but the recently returned Steve Jobs said, “the slogan was stupid because Apple wasn’t back [yet].” The idea of “Think Different” came to a member of the company’s external marketing team. After some debate over “Think Different” and “Think Differently”, “Think Different” was chosen and the rest was history.

For us, to “Think Different” we must first understand the world we’re investing in and how it may be changing. A static approach to markets works in a world that isn’t dynamic, but one glance at the headlines in the newspaper (yes, there are a few of us still reading news that way) quickly disabuses one of that opinion.

We recently received an email from a well-read, thoughtful client who, in preparation for an upcoming meeting, wanted to understand how much he should be thinking about his investments in the context of a change in the post-World War II order. My initial thought was that we’ve already experienced some shifts in the post-World War II order (particularly in the 1970s), and what we’re seeing today is simply another shift. Ironically enough, the big changes in the 1970s (Nixon opening relations with China, the U.S. going off the gold standard) echo with the sorts of things happening today with China flexing their muscles globally and gold prices touching new all-time highs. Russia’s invasion of Ukraine in 2022 sparked severe financial sanctions that have caused many countries outside the West to rethink their reliance on the existing global financial order.

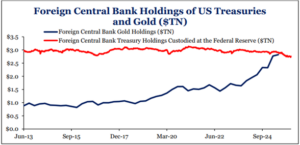

One chart that highlights the changing world is shown below. The behavior of foreign central banks has been quite different in recent years. While these banks have begun to slightly decrease their holdings of U.S. Treasuries, they have dramatically increased their holdings of gold reserves from around $1 trillion a decade ago to close to $3 trillion today.

Source: Strategas

One way in which we seek to “Think Different” is our use of strategies that seek to gain exposure to Real Assets (real estate stocks, infrastructure stocks, commodities, and natural resource stocks) which has been an area of strength in recent years. While some firms divide the investment landscape into a binary of stocks and bonds, we find that a broader approach can be useful in times of change.

The Joseph Group’s Senior Investment Analyst, Jerry Brown, and I recently had a call with a team that manages natural resource stocks in one of our portfolios. We talked a little about how much the world has seemingly changed in recent years. One of the key takeaways from our conversation is that the sorts of trends going on globally (Central bank demand for gold, artificial intelligence, infrastructure buildout, electrification needs) argue for exposure to assets that are critical in delivering on these trends.

The team also expressed their belief that the market is still largely ignoring companies critical in extracting and processing natural resources. The chart below shows the valuation trends for the S&P 500 and natural resource stocks over the last 15 years. Until Covid-19, there was little daylight between the valuations of these parts of the market. Today, there is a yawning gulf.

Source: CoreCommodity Management

We recently modestly increased target exposure in many client accounts to Real Assets in part because of the valuation gap, and in part because of the benefit to diversification we think these sorts of investments can provide in an era of more pronounced resource supply constraints and increased demand. Having the “chassis” to do these sorts of things in objectives-based client portfolios is something that we think makes us different from a lot of our peers.

The advice to “Think Different” is embedded in TJG’s core value of humility and is woven into the DNA of The Joseph Group in all sorts of ways that go beyond investment management. We don’t know what tomorrow holds, but we firmly believe an investment approach that has the flexibility to think and look different is one that is well suited to helping our clients live their great lives!

Written by Alex Durbin, CFA, Chief Investment Officer