Thinking About Dividends

May 15, 2020

To inform:

Earlier this week TJG Portfolio Manager Alex Durbin and I had a chance to have a video call with Mark Nabi, an Investment Director at Capital Group, regarding the status of company dividend payments in the current environment. According to Nabi, “dividends remain an important source of income for investors, but with much of the world in quarantine, dividends are at a crossroads.”

Let’s Get the Bad News Out of the Way

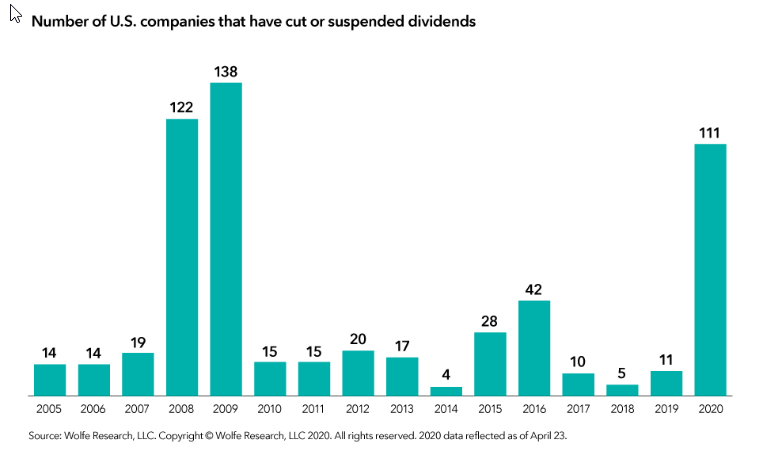

The Great Lockdown has definitely had an impact on stocks paying dividends. Dividend cuts and suspensions by companies have jumped to the highest level in more than a decade. The chart below provides some perspective – as of April 23, 111 U.S. companies have cut or suspended their dividend payments to investors, the highest level since 2009. The reasons for the dividend cuts vary, but as sales have slowed, companies are seeking to preserve cash and, in some areas, (i.e., banks), dividends are a source of political pressure as regulators want to see capital preserved during the pandemic.

Source: Capital Group

All is Not Dark – There Are Lots of Bright Spots

It is important to note not all companies are cutting their dividend. Here in the U.S., a few companies have actually raised their dividends recently, despite the pandemic, as they have made their quarterly earnings announcements. We cannot mention specific company names, but a major consumer products company (which makes toilet paper and laundry detergent) as well as a large health care company (which makes pharmaceuticals and baby powder) are among the notable dividend increasers. In addition, multiple companies have committed to maintaining their dividends despite the challenging environment, including a major coffee company and a large integrated oil/energy company.

Dividends for companies outside of the U.S. are another important consideration for investors. Nabi noted a number of companies in Europe have expressed strong support for paying dividends as planned, which we are pleased to see.

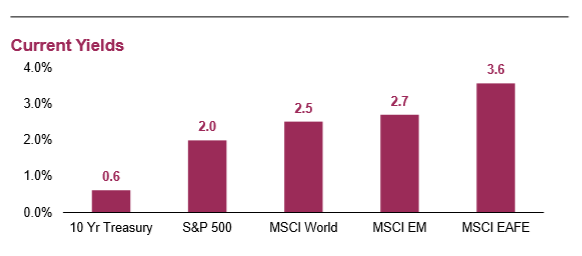

Perspective on Sources of Income

The chart below shows current income yields as of April 30 (and is included in the May Market Health Analysis packet put together by The Joseph Group Team). Despite the recent dividend cuts, investors can earn more income in stock dividends than they can in government bonds. The current interest rate on the 10-year Treasury note is 0.6%, while the dividend yield on the S&P 500 is 2% (and that is after cuts). Outside of the U.S., dividend rates are even higher with the income rate on the MSCI EAFE (Europe, Australasia, Far East) index at 3.6%. Bonds are generally less volatile than stocks, so we certainly don’t want to imply conservative investors focused on income should only look at stocks, but when the dividend rate on stocks is 3x to 6x the level of the income rate on bonds, we want to consider the opportunity for long-term investors.

Source: Eaton Vance/FactSet

How TJG Looks at Dividends in Provision

Dividends are an essential part of how The Joseph Group seeks to achieve the objective of the Provision Strategy we manage on behalf of clients. The purpose of Provision is to provide cash flow and produce a “sustainable withdrawal rate” which can be used to support cash flow needs. All of the stocks we hold in Provision have a dividend focus because having a growing stream of income is a key part of addressing the objective. When we are looking at dividend stocks/stock funds for Provision we divide our dividend focus into three sleeves:

- High Current Dividend Yield – These are companies which are paying high current income rates today. Examples may include utilities or communications companies where the dividend yield is meaningfully higher than that of the S&P 500.

- Dividend Growth Stocks – These are stocks where the current rate of income may not be as high, but the company has a history of increasing the dividend over time. Warren Buffett has a relatively famous example where he talks about earning more in dividends each quarter from the stock of a particular beverage company because of the way the dividend has grown over time. Today, a number of technology and health care stocks fall into this “dividend growth” category.

- Foreign Stocks – With the average dividend rate on foreign companies being higher than the dividend rate of U.S. indexes, we want to make sure we include income opportunities outside of the United States.

In the current environment we have positioned portfolios with a bias toward Sleeve 2 – Dividend Growth – because it is where we are seeing the greatest likelihood of dividend sustainability.

Speaking of Sustainability – A Word of Caution

There is old Wall Street maxim that “more money has been lost reaching for yield than at the point of a gun.” One interpretation of this saying is that rather than being robbed, investors who purchase stocks based on a high dividend yield may be disappointed as those stocks fall in price. We love dividends, but in this environment, it is more important than ever to look for dividends which are sustainable. We are wary of companies which are showing dividend rates in excess of 8-10% as we think those are companies which will have a higher rate of dividend cuts. Companies which have strong balance sheets with less debt may have a lower dividend than a more leveraged company, but that lower dividend may have a greater likelihood of being maintained over time.

Bottom line – in an environment of low interest rates, dividends are an essential part of earning investment income. In the current environment, diversification among sectors and a focus on sustainability of those dividends can really…pay dividends.