Thoughts on the Wuhan Coronavirus

February 14, 2020

To Inform:

It’s not the most fun thing to think about on Valentine’s Day weekend, but our financial news feed is being dominated right now by the Wuhan coronavirus and its potential impact on the global economy. While our discussion here focuses on the economic impact, our prayers are for the much more terrible human impact this virus has had.

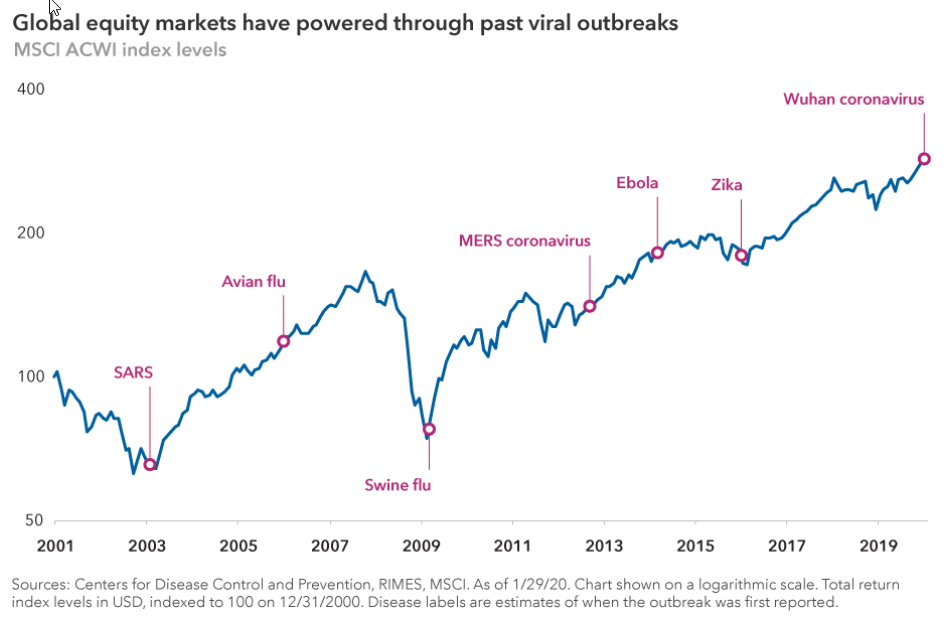

One of the questions we have received from clients is, “how has the market acted during past disease outbreaks?” Below is a chart which goes back to the end of 2000 showing the global stock market marked with the timing of past viral outbreaks. When you look at the chart, there really is not much of a pattern. If anything, some past outbreaks have coincided with market lows while with others, if the market was in an uptrend, that uptrend tended to continue.

Source: Capital Group

When we look at the stock market in recent weeks, headlines about the virus have coincided with some day to day volatility, but overall, major stock indexes have continued to move higher, with the MSCI All Country World stock index up about 2.5% YTD. One area though where we have seen significant volatility is with energy. Below is a chart showing oil prices over the last six months. After registering a 6-month high of over $64 on January 7th, light sweet crude oil is trading at about $52 today. That’s a drop of about 19% in a bit over 5 weeks.

Source: Yahoo Finance

With the eye of the storm of the virus in China, the impact is going to be most keenly felt there. Stephen Green, an economist with Capital Group, had this to say about the impact in China: “Given the quarantine lockdowns, it’s highly likely that the numbers of infected people in mainland China are significantly underestimated, especially in rural areas where medical facilities are limited. Depending on how long it takes to contain the coronavirus, we should expect to see sizable declines in consumer spending and manufacturing activity at least through the end of February. I wouldn’t be surprised if China’s first quarter economic growth falls below 6% and some estimates are as low as 5% which is in the realm of possibility.” The Joseph Group investment team notes that China’s Central Bank has been accommodative and has been pumping liquidity into the Chinese economy to soften the impact.

So that’s the perspective in China, what about here in the U.S.? Another Capital Group economist, Jared Franz says, “The economic impact of the coronavirus on the U.S. is more difficult to calibrate, but I expect it to be modest and mostly felt through trade disruption and financial linkages. Assuming the outbreak is contained soon, it’s likely global economic growth will experience a V-shaped recovery characterized by slower growth in the first half and a significant acceleration in the second half of the year.”

So, what is The Joseph Group currently doing/thinking? Across our client accounts, we are generally overweight stocks, but we have those stocks paired with small risk hedges in the form of short-term bonds or gold, depending on which is more appropriate for the objective of the strategy. Most of our research supports the conclusion the officially named COVID-19 virus will have a limited impact on markets but it is something we will continue to monitor, even if it interferes with Valentine’s Day.