To Roth or Not to Roth – What Should You Do?

October 21, 2020

To Roth or not to Roth, that is the question. The question that many investors saving for retirement will need to answer at some point in their lives, whether they are just starting out in their careers or are nearing retirement. But where do you start?

First, let’s look at some key differences between a Traditional IRA and a Roth IRA.

Contributions:

- Traditional IRA – Contributions are typically made with dollars that have not been taxed. Tax deductibility is subject to IRS qualifications regarding income and active participation in an employer-sponsored retirement plan.

- Roth IRA – Contributions are made with dollars that have already been taxed. Contribution eligibility is subject to income limits.

Withdrawals:

- Traditional IRA – Withdrawals of principal and earnings are taxed as ordinary income; thus, traditional IRAs are considered tax deferred. All withdrawals prior to age 59 ½ are subject to an additional 10% penalty unless due to death, disability, or other qualified distribution.

- Roth IRA – Withdrawals from Roth IRAs are treated as being distributed in the following order: principal, conversions, earnings. Withdrawals of principal may be made income tax and penalty free at any time for any reason, because you have already paid income tax on those dollars. Dollars converted from a Traditional IRA to a Roth IRA are eligible to be withdrawn income tax free at any time because you paid income tax at conversion; they will also be penalty free if the dollars were converted more than 5 years prior to the withdrawal. Earnings are income tax and penalty free if taken after age 59 ½, otherwise they may be subject to income tax and an additional 10% penalty unless due to death, disability, or other qualified distribution.

Required Minimum Distributions (RMDs)

- Traditional IRA – RMDs are required to begin at age 72. Due to the CARES Act, the RMD requirement has been suspended for 2020, so no RMD must be taken this year.

- Roth IRA – There are no RMDs required in the account owner’s lifetime.

Now that we know the key differences, here are some questions you may want to ask yourself before you choose which type of account to contribute to:

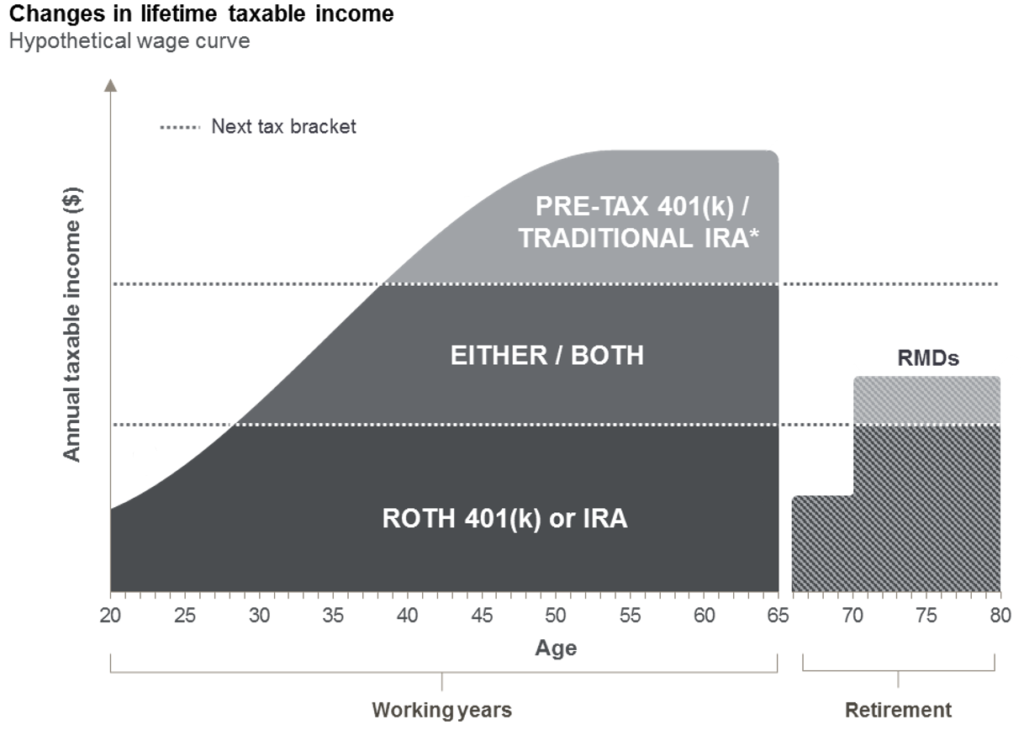

- Is my income now lower than it is expected to be when I retire? One of the most important considerations is how your future tax bracket will compare to your current tax bracket. If you are expecting your income to significantly increase, you may want to consider contributing to a Roth IRA and paying tax on those dollars now while you have a lower tax rate, so you can withdrawal them tax-free and avoid paying higher taxes later on.

- How long do I have until retirement? A Roth IRA is a great choice for younger savers who have a long time horizon before they retire because the earnings will have that much longer to grow tax-free.

- Am I a candidate for Roth Conversions? If you have minimal income this year, haven’t reached age 72 yet, and a large portion of your assets are in a Traditional IRA, you may want to considering doing some Roth Conversions. You can transfer part of your Traditional IRA dollars to Roth IRA dollars, which allows you to recognize taxable income now while you are in a low tax bracket in return for tax-free distributions later when you are in a higher tax bracket.

- What savings goal are you trying to accomplish? With a Roth IRA comes a certain degree of flexibility. If you need access to funds in an emergency before age 59 ½, you may withdrawal your contributions without tax or penalty. On the other hand, if you don’t want to touch the funds at all in your lifetime and are looking for a way to pass dollars on to future generations, a Roth IRA is a great tool to use. You won’t be subject to RMDs and your heirs will not have to pay taxes on distributions, which is especially beneficial if they are in high tax brackets.

Source: JP Morgan

Both traditional and Roth IRAs are effective long-term savings tools, but one may better suit your goals than the other. We love helping our clients achieve their goals so they may live a great life, so if you have any questions about funding a Traditional or Roth IRA, please contact me or your Joseph Group Advisor.

This WealthNotes was written by Bridget Head, Wealth Advisory Associate