Tree Rings and Investment Portfolios

January 2, 2026

To Inform:

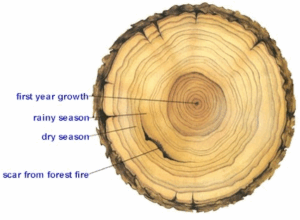

I was driving home from a New Year’s Eve party when I began to think about what I wanted to write in the first WealthNotes of 2026. The Joseph Group CEO Travis Upton so succinctly wrote about themes we’re watching in the year ahead recently. An “outlook” thus being ruled out, I began thinking about trees and tree rings. Tree rings, as you may well remember from your days as a student, can tell us a lot about a tree. There’s even a term for the study of tree rings – dendrochronology. The examination of a tree’s annual growth rings tells us not only a tree’s age, but also the sort of life the tree lived. Wide, fat spaces between concentric rings indicate years in which water and sunlight were plentiful and the tree grew faster. Tighter spaces indicate years of drought or other restrictions that inhibited the tree’s growth. Fire scars and other damage can also be seen in a tree’s set of rings.

Source: Earthscience Australia

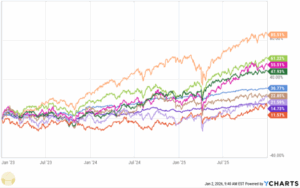

The life of an investor can look a lot like the set of tree rings seen when we cut down a tree. There are years where markets are generous, profits rich, and the investor’s “growth rings” are wide. There are other years where perhaps profits were lean, maybe some fire damage is evident. Looking back over the last 3 years, we see a set of wide tree rings. Every major asset class has generated positive returns. The chart below shows the returns of a host of ETFs that track a range of major asset classes. For purposes of this illustration the names of each ETF matter less than the direction of travel – up.

Source: YCharts

Will rings over the next few years be as wide? We can’t know with certainty. We think it is possible we see some areas of leadership rotation in the markets this year – yesterday’s winners allowing others to find their time in the sun. What we do know is that just like in a tree, no two years will be exactly alike.

One of the interesting things about tree rings is what you see after a forest is timbered. Trees growing in the shade of much larger trees must compete for sunlight and nutrients and thus grow slowly, with very tight growth rings. If the forest is selectively timbered, the tall trees come down, opening the canopy for the smaller trees. The impact of such an event can be seen quite clearly – in the years following a harvest, surviving trees pack on the growth, exhibiting wide growth rings.

This idea of a selective harvest can be applied to investment portfolios. Whether it is trimming winners to take profits or reallocating longer-term, growth-oriented portfolio dollars towards strategies focused on income and meeting present-day spending needs, the beginning of a year is a great time for the investor to think about how best to “manage the forest.”

The most important lesson I hope we can draw from the life of a tree is to expect change. Each year a tree deals with varying rainfall, inconsistent sunlight, insects and animal damage, and a host of other threats. But growth goes on. Markets are no less dynamic than the threats posed each year to a tree, but an investor with a plan is no less resilient than the trees growing around us. Now, here’s to 2026 with hope for another “fat ring” year!

Written by Alex Durbin, CFA, Chief Investment Officer