Vaccines, Leadership, and Sentiment

December 4, 2020

To Inform:

One of the headlines in the December 3rd edition of the Wall Street Journal said “Covid-19 Vaccine Cleared For Use In UK.” After strong results from clinical trials, vaccines are being pushed for clearance for emergency use and distribution is expected to begin (in limited numbers) within days.

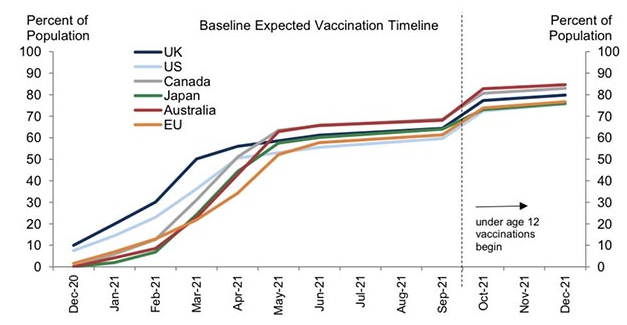

Wider distribution of the vaccines will take time and the chart below gives some perspective on how long it may take. Initially, the plan is for vaccine distribution to start with high risk groups, mostly health care workers and individuals with comorbid conditions, and those are the groups which will receive initial doses this month. Distribution is expected to ramp up by February of 2021, and as the chart shows, over 60% of the population in major developed countries is expected to receive the vaccine by next April.

Source: Goldman Sachs Global Investment Research

From a market perspective, one of the most important impacts we believe the vaccine news has had is a shift in leadership. Though most of the year, stock leadership has come from a few big technology companies and the average stock in the S&P 500 (as measured by the equal weight S&P 500) was negative through the end of October. That’s changed in a big way in November as economically sensitive “reopening” stocks as well as smaller companies have benefitted. The three red circles in the chart below illustrate this shift in leadership. Specifically:

- S&P 500 vs. ACWI (All Country World Index) – International stocks outperformed in November

- S&P 500 Growth vs. S&P 500 Value – Value stocks outperformed in November

- Russell 2000 Smallcaps vs. S&P 500 – Small cap stocks outperformed large cap stocks in November.

Source: 361 Capital, StockCharts.com

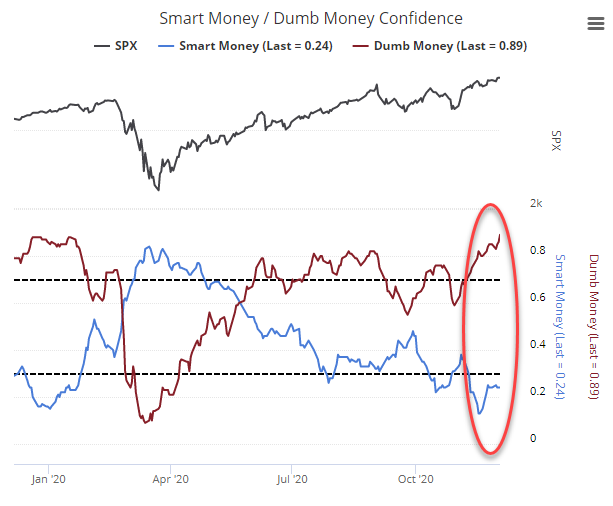

The future looks bright, but at the risk of being a wet blanket, if there is one “fly in the ointment,” it’s perhaps TOO much optimism. Doug Ramsey, Chief Investment Officer of the Leuthold Group, calls investment sentiment “euphoric” and notes the current level of optimism among newsletter writers was never even achieved during the bull markets of 1990-2000 and 2002-2007. Our own favorite sentiment gauge is the Smart Money/Dumb Money indicator which measures extremes between “smart money” institutional investors and more emotional “dumb money” investors. The last time the gap was this large with the “smart money” being cautious and the “dumb money” being optimistic was at the previous market highs this past February, before the pandemic outbreak.

Source: Sentimentrader.com

How do we reconcile all of this information? We’re not overly alarmed with the sentiment readings as sentiment tends to be a much better gauge of market bottoms than tops. We believe the market can continue to grind higher, but it may not be a straight line from here and diversification makes sense. When it comes to the stock market, we believe investors will look for opportunities in cheaper stocks with good cash flows and areas such as foreign stocks, value style companies, and small cap stocks can continue to benefit.

As we approach year end and the holiday season, the vaccine news looks like a well-timed gift from Santa. As investors digest the good news, we think a re-focus on fundamentals is in store for 2021. The Joseph Group team will be sharing our thoughts on creating a game plan for positioning for 2021 at our Portfolios at Your Place event on December 15 at 4pm. (Portfolios at Your Place – December 15 – The Joseph Group). We invite you to join us.

This WealthNotes article was written by Travis Upton, Partner, CEO and Chief Investment Officer