Views from Wall Street

October 27, 2023

To Inform:

Earlier this week Alex Durbin facilitated our regular Investment Committee meeting. As part of the agenda, we discussed asset class views which form the basis of positioning for the objective based portfolios we have the privilege of managing for clients. We then did a deep dive, comparing those views to those of various Wall Street firms. With everything going on in the world – higher interest rates, war, earnings, politics…it makes sense to see where the views on Wall Street either confirm or challenge our own views. Here are some highlights:

Goldman Sachs

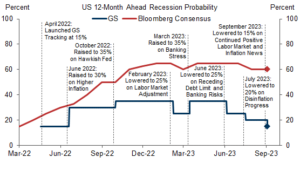

We joked during our meeting that despite world events, “Goldman seems to be positive on everything.” In the chart below, Goldman (blue line) shows their “probability of recession in the next 12 months, which was lowered in September to 15%, compared to the economic consensus (red line) which is approximately 60%. According to Goldman’s Chief Economist, Jan Hatzius, “The continued positive inflation and labor market news has led us to reduce our recession probability.” A key aspect to their optimism is the belief the Fed is done raising interest rates – “our confidence that the Fed is done raising interest rates has grown in the past month.”

Source: Goldman Sachs Global Investment Research

Given the positive backdrop, Goldman acknowledges stocks could be choppy in the near but their 12-month price target of 4700 for the S&P 500 implies more than a 13% gain from current levels. They also believe long-term interest rates will settle out in the months ahead at levels lower than today, implying price gains for bonds in addition to interest income.

Goldman gets more granular with positive views concerning foreign stocks and small caps. Here are a couple of quotes:

- “There are compelling reasons to increase international equity exposure, including low market concentration, resilient European corporate profitability, and cheap valuations relative to U.S. counterparts.” – GSAM Market Pulse

- “In our view, US small-cap stocks are attractive. For one, profitable companies in the Russell 2000 (small cap) Index trade at an unusually steep discount relative to peers in the S&P 500 Index. Second, small caps tend out to outperform large caps when inflation falls from high levels…” – GSAM Market Pulse

Strategas Research Partners

Strategas, an independent research firm based in New York, is perhaps the most cautious of the group. Starting with a base of 60% stocks and 40% bonds, Strategas is “underweight” both stocks and bonds and has been recommending small allocations to gold and commodities and diversifiers.

In recent weeks, Strategas has started to add to their bond allocations, “acknowledging the peak in rates may not be in,” but citing favorable “risk-reward opportunities,” meaning if there was a downside economic surprise, and rates were to fall, bonds could experience price appreciation.

Within stocks, Strategas’ views favor foreign and value stocks and shy away from growth stocks. With a small number of technology stocks leading this year’s market (at least before this week), Strategas’ view here has been wrong so far, but they would cite cheap valuations for value and foreign stocks as a “cushion” should broader economic growth disappoint.

JPMorgan Asset Management

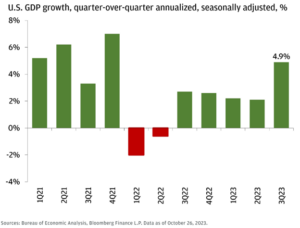

JPMorgan’s base views start with “underlying resilience of the US economy.” As seen in the chart below, the bars showing quarter over quarter US economic growth are not only positive, but reaccelerating. When coupled with “continued moderation of inflation” the result is a constructive backdrop for investors.

Source: JPMorgan

When it comes to stocks, JPMorgan is “neutral” saying stocks may have “limited upside due to valuations and high interest rates, but it’s hard to be too pessimistic as recession is not the base case.” JPMorgan’s is “overweight” bonds focusing on “attractive income as rates and inflation cool.”

Doing a deep dive on the views of various Wall Street firms is helpful to check our own thinking as we seek to meet client’s long-term objectives. Markets have been volatile the last few weeks, and with headlines around politics, war, recession fears, and Halloween around the corner, it’s easy to get spooked. I heard a quote today which is going to stick with me – “markets don’t calm down, they calm up.” In other words, when everything “feels” better, prices are already higher.

Written by Travis Upton, Partner, CEO and Chief Investment Officer