Was Yesterday a Major Market Leadership Turning Point?

July 12, 2024

To Inform:

Last night I had the opportunity to attend the monthly meeting of a group of friends who have an investment partnership. Each month they meet, have a lively discussion about stocks, vote on portfolio changes, and enjoy amazing food. They let me come to the meetings as a “strategic advisor” which is a fancy way of saying I talk about the markets in exchange for food. Last night’s meeting started with a comment, “ugh, it was an ugly day for the market…” I replied, “actually, looking at the numbers, most stocks were up, and it was a terrific day!” So, where is the disconnect? Here is the punchline for this entire article:

Yesterday (July 11) saw a massive one-day shift in stock market leadership with big technology stocks declining and other sectors and areas of the market performing well.

First some background, what happened yesterday? Here are three key points:

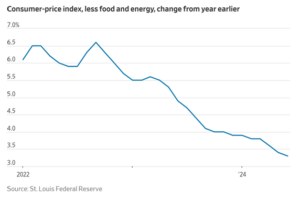

- June’s inflation numbers (released Thursday morning) came in better than expected, with inflation still moving prices higher, but at a significantly slower rate.

Source: Wall Street Journal

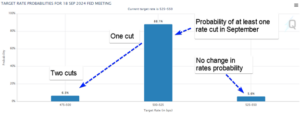

- A slower rate of inflation, coupled with recent data showing a softer economy (that’s for another issue of WealthNotes) increased the probability the Federal Reserve will cut short term interest rates. Based on CME Fed Watch data, the market is now pricing in a 95.4% chance of a rate cut in September (see chart below) and at least two, if not three cuts by the end of the year. Lower rates imply higher bond prices and bonds rallied yesterday.

Source: CME Fed Watch, additions from TJG Global Investment Research

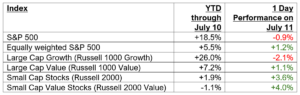

- Throughout this year, market leadership has been concentrated in a handful of large technology stocks. This leadership reversed to a large degree for one day, with value and small company stocks dominating yesterday’s performance.

Let’s elaborate on the third point. We made a table below showing the performance of different indexes on a year-to-date basis through July 10, and then the 1-day performance on July 11:

Source: TJG Global Investment Research, Data from Morningstar

As you can see, the year-to-date winners were yesterday’s decliners, while the year-to-date laggards were the outperformers. The 1-day gap between large growth and small value stocks was particularly noteworthy to us…a 6% performance differential in one day!

This morning, Bloomberg offered some historical perspective about how notable yesterday’s one-day swings were:

- Russell 2000 (small caps) beat the S&P 500 (large caps) by the most since March 2020.

- Russell 1000 Value beat Russell 1000 Growth by the most since January 2021.

The question going forward, “are yesterday’s market moves a sign of a bigger future leadership change?” We think it could be.

- First, The Leuthold Group put out a report earlier this week that one of their indicators triggered, indicating the “rubber band” of the relationship between the size-weighted and equal-weighted S&P 500 had been stretched to a level where we have historically seen a snap back. According to Doug Ramsey of Leuthold, “a similar reading in late 2020 foreshadowed two solid years of outperformance by the equally weighted S&P 500.”

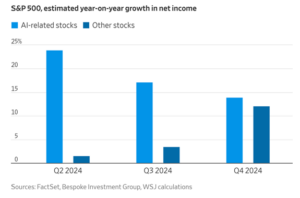

- Second, fundamentals support a broadening out of market leadership. As shown in the chart below, net income growth of AI-related stocks (a proxy for technology stocks), while still positive, shows a slower rate of growth. Meanwhile, the income growth of other stocks is accelerating.

Source: Wall Street Journal

We love reminding investors “the market tends to respond more to better or worse than it does good or bad.” The earnings outlook for technology stocks is great, but it’s other areas of the stock market where things are getting better.

One day does not make a trend, but yesterday’s market performance was a big deal. We’ll be watching for signs of a durable shift in market leadership, and if it happens, value stocks, small cap stocks, and sectors outside of technology may look more interesting than they have for a while.

Written by Travis Upton, Partner and Chief Executive Officer