Jobs, Manufacturing, Service – New High!

July 15, 2016

Here are what we are seeing with three major pieces of economic data:

1. Jobs

Last Friday, U.S. jobs data came in with a huge upside surprise creating 287,000 new jobs versus analyst expectations of only 160,000. Perhaps even more surprising was the fact that May was such a disappointment. Non-farm payrolls (jobs) were abysmal in May with only 11,000 new jobs created. The bounce back certainly eases fears of a near-term recession and supports the conclusion that the U.S. continues to be in growth mode.

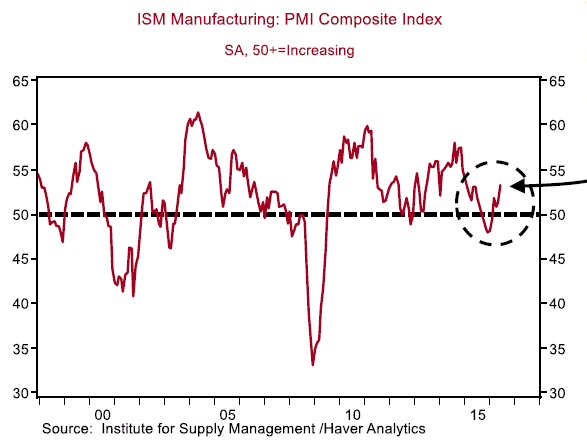

2. Manufacturing

Each month the Institute of Supply Manufacturing (ISM) publishes their Purchasing Managers Index (PMI) survey as an indicator of the economic health of the manufacturing sector. The PMI is based on data regarding new orders, inventory levels, production, supplier deliveries, and employment. In interpreting the data, the key number is 50 – anything above 50 signals expansion while anything below 50 signals contraction. The recent reading came in 53.2 – ahead of expectations and an acceleration from May’s reading of 51.3. After a dip below 50 earlier this year, the recent data is pointing to manufacturing activity growing at an increasing rate.

Source: Strategas Research Partners

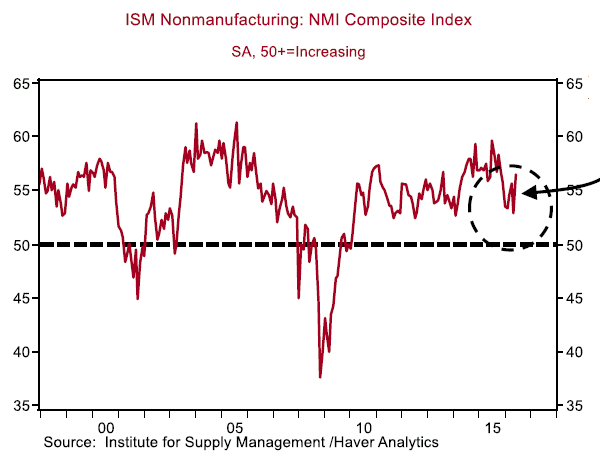

3. Services

Manufacturing is important, but services are a bigger part of the U.S. economy and we are seeing expanding growth there too. The ISM Non-Manufacturing index works the same way as the Manufacturing ISM (over 50 is good, below 50 is bad) and helps describe the health of the services sector of the economy (i.e., health care, food services, utilities, agriculture, entertainment). The Services ISM jumped to 56.5 in the most recent reading, up from 52.9 in May.

Source: Strategas Research Partners

We’ve headed into the third quarter with an “overweight” to global stocks and a “underweight” to bonds across our diversified asset allocation portfolios. That positioning has been challenging in the face of record low interest rates, but with new market highs supported by strong economic data, we’ve seen the relationship between stocks and bonds shift in the first two weeks of July.