What a Week in the Financial Markets!

August 2, 2019

To Inform:

Wow, what a week in the financial markets. This week saw three big market-moving events:

- 1. July 31, the Federal Reserve cut interest rates by 0.25% in a move that was widely expected. Before and after the announcement, the market was generally flat but had a sharp negative reaction during Chairman Powell’s press conference. The market wanted to hear more rate cuts were on the way. But, instead, Powell said this week’s rate cut was a “midcycle adjustment” and not necessarily the start of a bigger rate-cutting trend. After Powell’s comments, the closely watched Dow Jones Industrial Average finished down over 300 points.

Source: CNBC.com

- 2. The next day on August 1, the market seemed to decide Powell’s comments the previous day were no big deal, and by mid-morning, the Dow was up over 300 points, largely recovering the previous day’s losses. But, around 1:30 pm, another big news item hit – President Trump sent a tweet announcing new tariffs on roughly $300 billion worth of Chinese goods which would go into effect on September 1. The Dow reversed course and a 300-point gain turned into a 280-point loss by the close.

Source: CNN.com

- 3. Friday morning, the closely following jobs numbers were released where the Labor Department announced 164,000 new jobs were created in July and the labor force (the number of people in the working population) hit a record $164 million people. Overall, it was a positive number and indicates the economy continue to have some strength. However, the market was already down in pre-market trading and is lower as I type this. It seems the Fed and tariffs are more important to the markets right now than economic data.

Source: CNBC.com

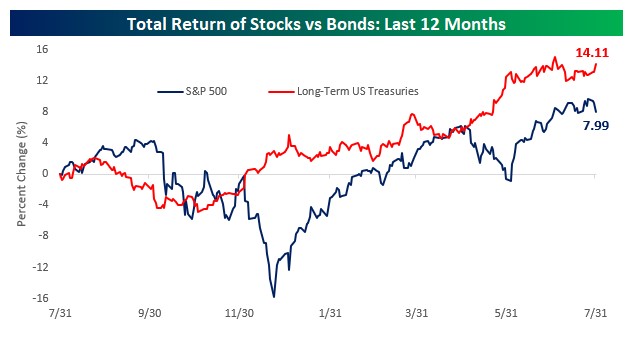

So, what are we thinking after a rough week in the markets? For one thing, we think it’s an important reminder about the benefits of diversification. Bespoke Investment Group sent out the chart below earlier this week and we will confess it even surprised us. It’s been widely publicized that U.S. stocks have hit record highs recently. However, over the last year, the US stock market has had close to a 20% decline and then a 20% recovery. Even the last few months have been a roller-coaster – U.S. stocks were down -6% in May and then +7% in June. At the same time, boring old bonds (the red line) have benefitted from declining interest rates and over the last year, despite U.S. stocks hitting record highs, high quality bonds have actually outperformed U.S. stocks on a total return basis.

Source: bespokeinvest.com

Source: bespokeinvest.com

The message we take away from the chart is this: diversification not only helps smooth the ride in financial markets, it also helps investors step back from emotion in a market that seems to be driven by headlines and tweets.

Have a great weekend!