What Does History Say the Market Should Do in 2022?

December 17, 2021

To Inform:

As we approach the end of a year there are typically multiple studies which look at past history for clues regarding what the market may do in the upcoming year. In this To Inform piece of WealthNotes, we’re going to look at two history pieces from highly regarded firms for clues regarding what may happen in 2022.

First, for context, barring any surprise craziness at the end of the year, 2021 should prove a positive performance year for most asset classes, especially large U.S. stocks. The chart below reflects year-to-date returns though early December and shows real assets (commodities and real estate investment trusts) have been the best performers closely followed by the S&P 500 (large U.S. stocks). Small caps (Russell 2000) and developed foreign (EAFE) stocks have maintained positive returns despite struggles late in the year, with only gold and Treasury bonds showing negative results. Assuming these results hold through the end of the year, the closely followed S&P 500 will have a return in excess of 20%.

(Sidebar: According to Goldman Sachs, 35% of the S&P 500’s returns through December 9th have come from 5 big technology stocks with the other 495 stocks in the index making up the rest, but that’s a discussion for another time.)

Source: The Leuthold Group

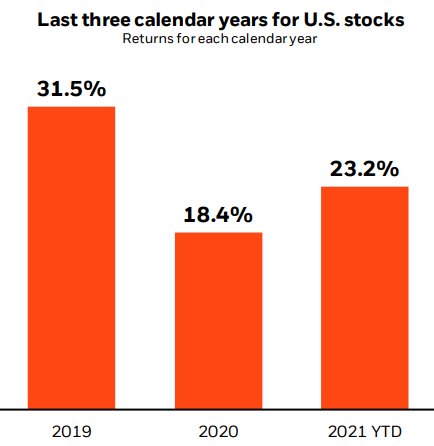

With that context, let’s look at the history lessons. BlackRock notes if the S&P 500 finishes the year with 20%+ returns, it will be the 3rd year in the row with returns in excess of 18%. With such strong numbers, the S&P 500 should be due for a negative year, right?…

Source: BlackRock Student of the Markets as of 11/30/2021

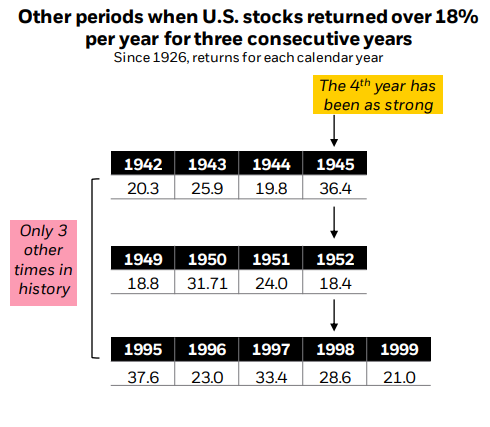

…Wrong – see below. BlackRock notes there have been three other periods since 1926 when the S&P 500 has returned over 18% in three consecutive calendar years and in the fourth year, the return has been every bit as strong all three times. In other words, if history repeats itself, the S&P 500 could be in for another year of double digit returns in 2022.

Source: BlackRock Student of the Markets as of 11/30/2021

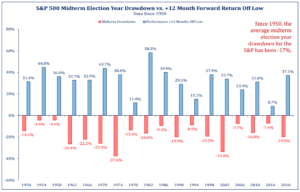

We love the optimism, but let’s look at another history lesson through the lens of politics which may provide a more cautious view. Next year, 2022, is a midterm election year and midterm election years are historically notorious for above average market corrections. In fact, going back to 1950, the average drawdown for the S&P 500 during a midterm election year is -17%, larger than in a typical year.

Source: Strategas Research Partners

The silver lining here though is those midterm election year corrections have been excellent buying opportunities with the average return from the low one year later being in excess of +30%.

So, how do we put all of this together as we approach 2022? The BlackRock study reminds us that a market shifting from early cycle to late cycle doesn’t mean market gains cannot continue, it merely means a shift from multiple expansion to earnings growth is needed to keep positive market trends going (and historically, this has happened). On the other hand, 2021 has been a year that so far has seen the biggest top to bottom pullback in the S&P 500 being a mere 5%…much smaller than the historical average. Next year could (and is likely in our view) to see more volatility and politics could be part of the mix. That said, history suggests when the volatility happens, we should look at it as a buying opportunity.

The flip of the calendar from 2021 to 2022 is going to bring a multitude of forecasts from the financial media. At The Joseph Group, we believe (with credit to Steve Leuthold) “forecasts are for show while the changes we make to portfolios are for dough.” We take the long-term objectives our clients are seeking to achieve through their portfolios seriously. We’re approaching 2022 with an optimistic view, but looking through the lens of having “brakes” in the portfolio to mitigate the impact of sharp downturns and giving us the ability to redeploy capital should cheaper opportunities present themselves. We value your trust and confidence and look forward to keeping you informed regarding what we are thinking and doing throughout what is likely to be an exciting year in 2022.

Written by Travis Upton, Partner, CEO and Chief Investment Officer