What Happens When The S&P 500 Isn’t Market Leadership?

May 10, 2024

To Inform:

I love it when conversations I have during the week fit together. On Wednesday, I had a phone call with a client who said, “I read an article talking about gains in the market being tougher to come by going forward…the next time we meet, I’d like to talk about what we are doing in the portfolio make sure we are well-positioned if that happens.” I responded by sharing a bit about one of our themes at the beginning of the year – “Be Mindful of the Lost Decade Toolkit.” In other words, how could investors have been successful during the 2000 – 2010 period when the annualized return of the S&P was negative over 10 years?

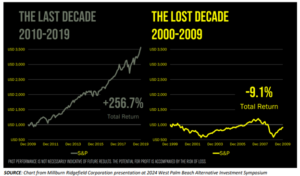

On Thursday, TJG Chief Investment Officer Alex Durbin and I had lunch with the team of fund managers for one of the mutual funds we hold in the Harvest Strategy we have the privilege of managing for clients. During the discussion, one of the fund managers shared the chart below. Their point was investors have enjoyed strong returns over the last decade, but valuations are high and may have more in common with the high valuations which prevailed in 2000 rather than the lower valuations which prevailed in 2010. Their conclusion: investors may need to “think outside of the S&P 500 to generate attractive returns.”

Source: Long Short Advisors

“The Last Decade” from 2010-2019 started with low valuations and saw expanding price to earnings (P/E) multiples along with growing earnings. “The Lost Decade” from 2000-2009 started with high valuations after the technology bubble (remember Y2K) and major events included the 9/11 attacks and the 2008 financial crisis.

Having higher valuations today doesn’t necessarily mean returns will be like the 2000-2009 period. After all, if corporate earnings continue to grow, stocks can continue to go up. However, higher valuations does mean there is a smaller margin for error and it is instructive to look at what DID work during the 2000-2009 period and what the playbook could mean going forward.

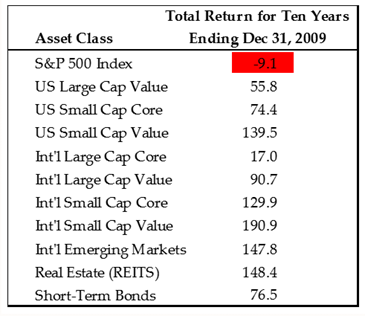

The table below shows the 10-year return for different asset classes during the same 2000-2009 period. It may have been a lost decade for the S&P 500, but investors who owned small cap stocks, value/dividend strategies, and foreign stocks enjoyed meaningful gains over the period.

Source: PrairieView Capital

I’ll again use one of my favorite Mark Twain quotes, “history doesn’t repeat itself, but it often rhymes.” Recent Investment Strategy Team meetings have discussed the cheapness of small cap stocks and yesterday, Alex sent an email out to The Joseph Group Investment Committee talking about recent leadership in foreign stocks.

Later this month when I meet with the client I talked to Wednesday about how we should position portfolios going forward if gains are harder to come by in the S&P 500, I’m going to share a quote from our own Alex Durbin: “diversification means you are always unhappy with something you own.” If large cap U.S. stocks are what investors are unhappy with, they may be glad they own some other things in their portfolio.

Written by Travis Upton, Partner and Chief Executive Officer