What If Longer Term Trends Reassert Themselves?

August 11, 2023

To Inform:

I recently read a research report which looked at longer-term trends in the financial markets. The report struck me because the trends are not necessarily in-line with recent market leadership, but if the trends assert themselves in the years ahead, it would have meaningful implications for portfolio construction.

First is the value of the U.S. dollar. The report discussed the U.S. dollar potentially being in the early stages of a secular downtrend. The chart below shows the history of the dollar going back to 1975 and as you can see, there have been decade plus periods where the trade weighted dollar has either strengthened or weakened. After a surge relative to other currencies in 2022, the report posits the dollar could be headed for a weakening period in the years ahead, and the recent downgrade of the credit rating of the United States by Fitch gives some potential credence to this view.

Source: Strategas Research Partners

Now, we are not talking about the Dollar losing its status as the world reserve currency, but if the dollar were to embark on a multi-year trend of weakening relative to other currencies, we believe it could have significant implications for asset allocation.

- A weaker dollar would generally favor hard assets and commodities such as oil, copper, wheat, and gold. Commodities all over the world are priced in dollars and all else equal, if the value of the dollar weakens by 10%, the value of commodities should appreciate by 10% for U.S. investors.

- A weaker dollar would also act as a tailwind for foreign stock performance. When foreign companies earn returns in Euros, Yen, or Rupees, and those returns are converted back into U.S. dollars, a weaker dollar adds to the performance experienced by U.S. investors.

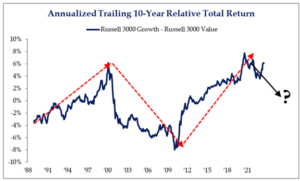

A second major trend is the performance of “growth” stocks relative to “value” stocks. Think of growth stocks as companies in sectors such as technology which are growing their sales and earnings rapidly. Think of value stocks as companies which are priced below their peers but provide strong cash flows and often pay higher dividends. The report posits performance leadership between growth and value historically moves in 10-year cycles, and the market could be poised for a multi-year run of value stock leadership.

Source: Strategas Research Partners

The immediate market surge post-COVID favored growth stocks, but the late 2021 through 2022 period showed value leadership. Recently, a small group of growth stocks has led the market since mid-March, but the report suggests the recent growth leadership may be “fizzling out again.” If that’s true, sectors such as industrials, health care, and even financials may show relative strength and dividend paying stocks, which have lagged so far in 2023, could show new life.

Yesterday, Alex Durbin, Jake Lindaberry (our new analyst!) and I were in a meeting with a fund company in town from New York. The fund company talked about a “new investing paradigm” where quality, undervalued dividend paying stocks and hard assets could be market leadership going forward (much like the trends described here!).

The “new investment paradigm” comment made me smile because as the oldest person in the room, I remember managing portfolios in the trust department of a bank in the early 2000’s. It was a time period when having foreign stocks and dividend paying stocks in the portfolio meant outperforming the U.S. market.

For nostalgia purposes, I ran a quick chart in Yahoo Finance looking at foreign stocks and value stocks compared to the S&P 500. I ran the chart below starting with a period where we could get good index data (12/31/2002), and in the chart, the darker blue line (on the bottom) represents the S&P 500, while the other lines represent foreign stocks and U.S. value stocks.

Source: Yahoo Finance, Index Data from 12/31/2002-12/31/2007

It may seem unlikely the performance trends in this chart could “rhyme” 20 years later, but if long-term trends re-assert themselves, what was old could become new again.

Written by Travis Upton, Partner, CEO and Chief Investment Officer