What Is Asset Class Performance Telling Us About Facts vs. Feelings?

March 3, 2023

To Inform:

An article in Thursday’s Wall Street Journal started with the sentence, “Stronger-than-expected manufacturing data Wednesday pushed stocks lower…” Wait, what? Isn’t better than expected data supposed to be good for markets? Sometimes that’s the case, but the current market environment is one of mixed signals as the market wrestles with the prospects for inflationary growth versus the prospects for recession.

When the usual “rules” are not working we like to look at what different areas of the financial markets are telling us. I keep a list of market indexes covering everything from stocks to bonds to oil on the CNBC app on my phone and each day I look at that list to get a sense of what asset classes are telling us. In other words, based on performance of different areas of the market, can we “reverse engineer” clues as to the bigger picture?

Let’s look at year-to-date performance across different asset class indexes and see what we may learn. (All asset class performance is year-to-date 2023 through 3/2/2023 based on data from Morningstar.)

High Quality Bonds

- Bloomberg Aggregate Bond Index: -0.47% YTD

- Bloomberg US TIPS – Inflation Protected Bonds: +0.24%

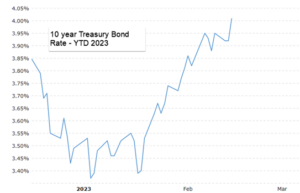

Bonds have had a wild ride so far in 2023. As seen in the chart below, the rate on a 10-year government bond started the year at 3.85%, moved down to 3.37% in mid-January, and then surged to 4.01% today. Since bond prices move in the opposite direction of rates, price gains bonds made in January quickly evaporated with the rate surge in February.

What do we make of this? The bond market seems to be digesting a shift from “inflation is fading” to “inflation is sticking around for a while” and the outperformance of inflation-protected bonds relative to regular bonds supports this conclusion. Despite survey data showing feelings of a weak economy, actual data has been relatively strong. We believe bonds are likely to outperform in a recessionary scenario, but recent action supports the idea a recession is NOT the market’s primary concern.

Source: MacroTrends.net

Credit (Junk Bonds)

- B of A US High Yield Bond Index: +2.17% YTD

Lower quality (junk) corporate bonds have outperformed higher quality bonds, which would make sense in a stronger growth environment. Below is a chart of the “spread” or the compensation investors get for investing in riskier bonds over the last 10 years. I feel like we have shown this chart a lot over the last few months, but recent data bears repeating it. With the idea lower numbers imply less credit stress, let’s put the current reading in context:

- Long term historical average: about +4.50%

- Recessionary type numbers: greater than +8.00%

- July 4, 2022: +5.93%

- March 1, 2023: +4.17%

Source: St. Louis Federal Reserve Economic Database

We believe the implication here is stronger growth and a healthy credit environment. Not only are spreads below their long-term historical average, but they are also significantly below their levels six months ago. In other words, not only are credit conditions strong, they have been improving over the last 6-8 months.

Global Stocks

- S&P 500 (Large US Stocks): +4.00%

- NASDAQ 100 (Tech/Growth Stocks): +10.25%

- Dow Jones Industrial Average (Value, Dividend Stocks): -0.15%

- MSCI EAFE (Developed International): +5.80%

- MSCI EM (Emerging Markets): +2.58%

There is a lot here, but looking at various areas of the stock market two key things stand out to us:

- First, growth/tech stocks are significantly outperforming value/dividend stocks based on the relationship between the NASDAQ and the DJIA. Last year’s relative losers have generally been this year’s relative winners and vice versa).

- Second, broad foreign stocks (based on the EAFE) are maintaining last year’s edge over broad US stocks (based on the S&P 500), with Europe driving the primary outperformance. We note this is happening with a rising dollar being a DRAG on foreign stock performance. The dollar has risen so far in 2023 and the rising dollar has subtracted about -2% from returns, but the EAFE is STILL outperforming. We believe this implies the valuation discount between foreign and US stocks is narrowing.

Growth stock leadership after last year’s decline may be telling us last year’s fear was overblown relative to fundamentals. And, the fact foreign stocks are outperforming despite the headwind of a rising dollar (like last year) may imply “de-globalization” may be a good thing for foreign stocks.

Real Assets

- Dow Jones Global Real Estate (REIT) Index: +2.33%

- Dow Jones Brookfield Global Infrastructure Index: +0.27%

- Bloomberg Commodity Index: -4.45%

- Gold: +0.72%

This group is perplexing. If growth is actually strong and inflation is still an issue, shouldn’t real assets (especially commodities), the assets most sensitive to inflation, be outperforming? Well, apparently not. Commodities are actually the worst performing group YTD. We read this as inflation may not be dead (higher interest rates) but it’s also not reaccelerating (lower commodity prices).

Putting It All Together

So far in 2023, the broad asset class winners are growth stocks and foreign stocks and the losers are commodities and bonds, with a dash of healthy credit markets.

If we only knew about asset class relationships from our senior year finance classes and didn’t know anything else about current events, we would say:

- Economic growth looks solid.

- Inflation is sticky but NOT accelerating. To use an analogy, the car is moving fast, but is no longer picking up speed.

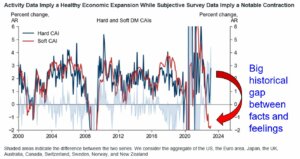

Since do know a bit about current events, we will add one more chart. Activity data has been strong (facts), but survey data (feelings) has been weak and the gap between facts and feelings is wide to a historic degree.

Source: Goldman Sachs Global Investment Research

So, what do we do about it? A term we have thrown out a lot at recent Investment Strategy Team meetings is “anti-fragile.” Rather than leaning too far in any one direction, such as avoiding recent losers (which would not have worked with growth stocks) or investing according to how we feel (we should know better), how can we make portfolios work in a variety of different scenarios? Right now, we believe constructing “anti-fragile” portfolios means owning some things which may not have worked a few months ago (like growth stocks) owning some things which have not worked for a long time (like foreign stocks), and even owning some things which aren’t working right now (like bonds and gold). Do those things may not “feel” good, but it may be what sets clients up for long term success in an uncertain world.

Written by Travis Upton, Partner, CEO and Chief Investment Officer