What To Do About Cash

September 1, 2023

To Inform:

“Cash is Trash” – Ray Dalio, 2018, 2020, 2022

I always chuckle when investment gurus make definitive statements, usually at the top of a market trend. The quote above was tried out thrice by Ray Dalio, famous founder of the hedge fund shop Bridgewater. Dalio is no fool but in all those instances, at least in the near term, the person holding cash after Dalio made these statements did pretty well relative to most other asset classes. So now, in 2023 should we be worried when Ray Dalio has changed his tune in recent months, proclaiming cash to be “pretty attractive now”?

Dalio is on to something, cash (be it in the form CDs, money market accounts, etc.) is a lot more attractive than it has been. Just how attractive, however, is where we’re going to dig in. Before any discussion about the merits of cash or alternatives, it is imperative that one considers their goals and objectives. “What role does cash typically play in my financial plan?” It’s then worth asking if one has the right amount of cash given those goals and objectives. Depending on how you answer these questions may mean cash may not be as attractive as many might think or Dalio might believe.

To support this idea, we’ve taken a look at how cash typically performs after the US Federal Reserve concludes a rate hiking cycle. While Jerome Powell and his colleagues may be playing things close to the vest as far as what might lie ahead, we can look to the market’s expectations for where the Federal Funds interest rate is possibly headed. Right now, the market is attaching odds of about 60% to the Fed being done hiking rates, with around 40% odds of one more hike of 0.25%. This is all after the Fed has already hiked rates 5% since they were pinned at zero. It is, I think, safe to say that even if the Fed isn’t done, they are pretty close.

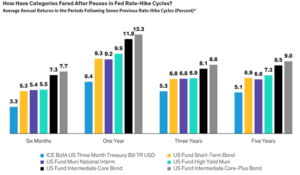

So, what happens when the Fed is done hiking? Cash does in fact do alright. But bonds of nearly every stripe do better. The chart below from AllianceBernstein looks at average returns over the last seven rate-hike cycles. While cash (in this case measured by the returns of 3-month Treasury Bills) does alright, other low-risk alternatives do much better. Whether it’s short-term bonds or high yield municipal bonds, the person who is willing to look beyond cash does much better over the ensuing months and years in asset classes other than cash.

Source: AllianceBernstein

Sure, the allure of cash right now, especially after such a long period where rates on cash were moribund, is high. But our advice is to start with the end in mind (what are my objectives?) and consider history. I’ve written in this space before about the danger of believing “this time is different” when it comes to investing. We believe that this time is not likely to be much different than previous fed hiking cycles.

That said, we acknowledge that investing is an art and a science. In this case, “the art” is thinking about how one should approach cash, the science is finding good information acting on it. In this case, “the science” is telling us not to be too easily swayed by the high current returns on cash, but to think about where some of the typical alternatives to cash might be headed. If we can keep pace with cash today, but come out ahead when the cycle turns, we’ll take that over listening to the gurus.

Written by Alex Durbin, CFA, Portfolio Manager