What’s Changed Since the Beginning of the Year?

March 15, 2024

To Inform:

This past week I had the privilege of being a guest speaker at two different meetings of Investment Clubs/Partnerships. It was fun for me to join in the discussion and hear their thoughts about the current market environment and where they believed opportunities exist in today’s market. These savvy investors were largely looking to take profits in areas of the market which had run recently and were looking to redeploy capital in other areas with food stocks, health care, and small company stocks being topics of conversation. I also learned saying the word “avocado” could be a polite way to tell someone they were talking too much during a meeting. Fortunately, it was only used on me once. 😊

My prepared remarks were focused on looking at our “Seven Themes Plus One More for 2024” and what has changed with those themes now that we were in the middle of March. Here are a couple of the key discussion points:

Theme: 2023 Took My Breadth Away

At the beginning of this year, investor attention was focused on the dominance of what the financial media called the “Magnificent 7” large technology stocks. Although last year was positive for markets, stock market breadth, or a measure of how many stocks were participating in the gains, was relatively narrow. A disproportionate amount of the return of the S&P 500 came from these seven large stocks, with the other 493 bringing up the rear.

A question on investors’ minds was “would the dominance of the “Magnificent 7” continue?” The answer – not really. If we look at the YTD 2024 performance of those seven stocks through mid-March, while we cannot name names, two are up 40%+, two are up over 13%, one is close to flat, and two are negative by over -10%. We are seeing movement, but the US stock market is no longer being dominated by this group of seven large technology stocks.

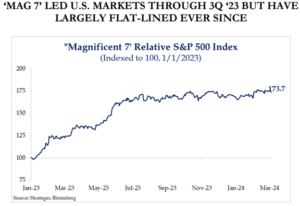

The chart below which looks at the “Magnificent 7” relative to the S&P 500 provides some perspective. The line moving up through early to mid-2023 reflects the dominance of the Magnificent 7 stocks. The line flattening out starting around August of last year reflects the fact that other areas of the market have joined the party. The fourth quarter of 2023 (October – December) saw smaller companies and sectors such as Financials, Real Estate, and Industrials begin to show strong performance which has continued into the first few months of 2024. The bottom line, “breadth” has returned to the stock market and while a few stocks are still front-page news, we are seeing a much wider group of stocks participate in the gains.

Source: Strategas Research Partners

Theme: Fed Cuts: Why More Important than When

In January, the Fed Funds futures market was pricing in significant rate cuts from the Federal Reserve in 2024. January Fed Funds futures were showing better than 50% odds of a rate cut in March and a total of as many of six 0.25% cuts, taking the Fed Funds from today’s 5.50% to a projected 4.00% by the end of 2024.

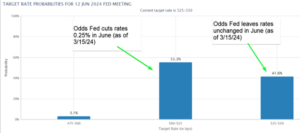

That was January, but that’s not how things are playing out. Now that we are in March, those same Fed Funds futures are showing a 99% chance the Fed will leave rates unchanged at their March meeting next week, and even a cut in June is now in question. The chart below shows probabilities of CME FedWatch as of 3/15/24. Odds are currently better than 50% the Fed cuts rates in June, but it is by no means a sure thing. If we look at the rest of the year, probabilities are now only pointing to a total of three cuts by December 2024, quite a bit different from the six cuts priced in two months ago.

Source: CME FedWatch

Our theme around cuts was “why the Fed is cutting is more important than when.” In other words, if the Fed is cutting because inflation is perceived to be getting “more under control” and not because of a fall off in the economy, then when should not matter. The market seems to have gotten the message and agreed with us. The chart below shows the probability of rate cuts (white line) next to the S&P 500 (blue line). Since mid-last year, U.S. stocks were moving almost in lockstep with Fed rate expectations, but as the market has priced in fewer cuts since late January, the S&P 500 has continued to rise. We believe this implies as long as investors see a strong economy with lower inflation, the timing of when the Fed actually does cut rates doesn’t matter so much.

Source: Bloomberg

So, what about the other six themes, including the election? I’ll shamelessly plug our Portfolios and Pints event next week where we will be talking about those themes and likely so much more. Even though St. Patrick’s Day will be over, we have a sparkly green hat, and Alex Durbin and I will be pulling questions out of that hat to discuss what is on your mind. Our “questions out of a hat” events have been some of our most well received. We invite you to join us at Crooked Can in Hilliard on March 20th and please bring a friend!

Written by Travis Upton, Partner and Chief Executive Officer