What’s the Deal with Negative Interest Rates?

August 23, 2019

To Inform:

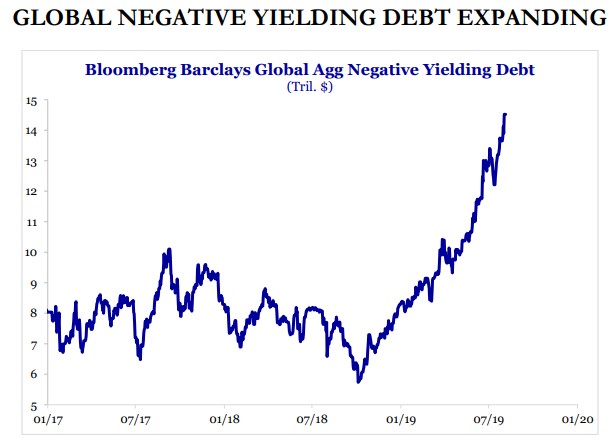

Earlier this week a capacity crowd attended our Portfolios & Pints event and we pulled topics out of a German hat (with a feather in it) to discuss with the audience. We covered current events such as the inverted yield curve and Chinese currency devaluation as well as big-picture topics such as The Joseph Group’s views on using active vs. index funds. One current event topic which garnered interest was the proliferation of negative interest rates around the globe. It isn’t supposed to work this way – bonds shouldn’t have negative yields because after all, you don’t pay someone to take a loan from you. However, as the chart below shows, the dollar value of bonds across the world with negative interest rates is growing, especially over the last few months.

Source: Strategas Research Partners

Source: Strategas Research Partners

We believe negative interest rates at Central Banks outside of the United States is one of the key starting points for negative interest rates in the global bond market. While the Fed Funds rate here in the U.S. is 2.25% (but expected to decline in September), The European Central Bank (ECB), the Swiss National Bank, the Bank of Japan (BOJ) and others have pushed short-term rates to zero or below in an effort to stimulate lending and economic growth. To wrap your head around the concept, think about a checking account that charges fees – you aren’t earning any interest, you are paying fees to the bank which means your effective interest rate on your deposit is negative. In the view of Central Banks, if it is costing investors to keep money at the bank, maybe they will do something else with it such as make loans, invest in capital projects, or buy corporate bonds or stocks. Negative interest rates at Central Banks are an experiment in economic stimulus.

Just as the Fed Funds rate influences interest rates on bonds here in the U.S., policy rates in other countries influence the rates on their bonds. According to Charles Schwab, over 40% of the negative-yielding bonds in the world come from Japan, with the rest from various European countries. When you consider the fact that some institutions such as banks are required to hold government bonds for regulatory reasons, it’s just not that simple to stop buying bonds even if the yields are negative.

So what are some of the potential implications of negative interest rates? Here are three which we discussed at this week’s Portfolios & Pints event:

- 1. Some investors are buying negative-yielding bonds as a growth play. It sounds wacky, but remember bond prices move in the opposite direction of interest rates. If rates on negative-yielding bonds go more negative, the prices of the bonds will go up, resulting in gains for investors.

- 2. Negative rates overseas likely will act as a sort of ceiling for rates in the U.S. An investor who is looking at earning -0.50% on a German Bund vs. 1.5% on a U.S. Treasury is likely to find the U.S. bond relatively attractive, creating demand for U.S. bonds and putting downward pressure on U.S. interest rates. As a result, the lower rates go outside of the U.S., the harder it will likely be for rates to rise meaningfully here in the states. While anything can happen, investors who are looking at bonds as a “safe haven” need to be selective, but may be comforted that external forces are working to keep rates low.

- 3. Negative interest rates are supportive of gold prices. While we are not big gold bugs here at The Joseph Group, we believe negative interest rates support gold. One of the big investment knocks against gold is that it costs money to store it. Investors refer to these storage costs as “negative carry.” When the competition for capital includes global bonds which may have even greater “negative carry,” gold looks a little bit shinier.

Have a great weekend!