When Bad News Is Good News for the Markets

February 16, 2024

To Inform:

My Father-in-law is so kind to me. Yesterday I was on the phone with him, and he asked, “T, are you doing okay? I saw the market was down over 500 points earlier this week!” My response was, “Oh yes – it was a blip – the market was down Tuesday, but up Wednesday and Thursday and it’s right back to where it was at the beginning of the week. No big deal.”

While five days is too short of a time horizon for true investing, here is an illustration of what we are talking about – a big drop on Tuesday, but recovery on Wednesday and Thursday to take the market back where it was at the start of the week.

Source: CNBC.com, 5-day S&P 500 Chart as of 2/16/2024

We never want to say “this data point caused this reaction” because it would be a gross over-simplification of how markets work. That said, there are two economic data releases this week we think should be important to investors.

- On Tuesday, the Core Consumer Price Index (CPI), a popular measure of inflation, came in hotter than expected: 0.39% for January compared to 0.30% expected. On an annual basis, this equates to a year-over-year rate of 3.9% compared to consensus expectations of 3.7%. In other words, inflation data came in hotter than expected, which implies the Fed may be slower to cut interest rates in the months ahead. More on that later.

- On Thursday, core retail sales fell sharply – down -0.4% in January with negative revisions to December. Quoting Goldman Sachs Macro Economic Research: “the retail sales report was below our previous expectations and implies downside to our Q1 GDP and consumption estimates.” Said differently, the retail sales data points to weaker economic growth.

Again, with the caveat we never want to look at one data point to try to explain markets, weaker economic data does not seem to line up with a +348-point recovery in the Dow on Thursday, but that’s what happened. Why?

We believe the answer is that the market is laser focused on when the Fed will cut interest rates.

Tuesday’s inflation data rattled market expectations of interest rate cuts later this year. To quote Bloomberg opinion writer John Authers, “After a startling inflation report for January, it’s plain that Goldilocks’ porridge isn’t too cold, at least not yet – but it may very well be too hot.”

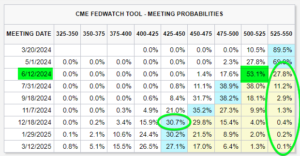

One of the biggest impacts of Tuesday’s inflation data is Fed Funds futures moving from pricing in as many as 5-6 rate cuts this year to only pricing in 3-4. Let’s look at the current CME Fed Watch to see where we stand today.

The table below is packed with data. It comes from the CME Fed Watch and looks at each meeting date for the Fed over the course of the next year and shows the probability of what short-term interest rates will be after that Fed meeting. All the way to the right is the current Fed Funds rate range of 5.25% – 5.50%. Higher probabilities moving to the left as the dates move down reflect the probabilities of the Fed cutting rates. We know the table is confusing, so let’s unpack three key conclusions:

Source: CME Fed Watch as of 2/16/2024

- After the hot inflation data, a March cut is improbable, and a May cut is unlikely too. The market is now placing the highest odds on the Fed to start cutting rates in June.

- There is more uncertainty around the timing and amount of rate cuts than a month ago. A month ago, Fed Funds futures were pricing in a 100% chance of rate cuts in June. Today, odds still favor the Fed cutting in June, but no cuts at all is a small, but still positive probability.

- A month ago, Fed Funds futures were pointing to six 0.25% rate cuts in 2024. Today, probability supports only four cuts in 2024.

Looking forward, we believe the market’s focus on interest rates could mean bad news is good news (and vice versa) when it comes to economic data. Strong economic data may sound good, but if it reduces the probability of rate cuts later this year, the stock market may not like it. The opposite is also true. Data showing weaker jobs numbers or slowing growth may sound negative, but if it means the Fed may cut rates sooner, weak data could lead to a market rally.

Bottom line – in the weeks and months ahead, bad news for the economy may be good news for stocks. The market seems to want the Fed to serve up a meal of lower interest rates…the economy may need to blow off some the heat in order to make that meal cool enough to eat.

Written by Travis Upton, Partner and Chief Executive Officer