When Good News is Bad

December 20, 2024

To Inform:

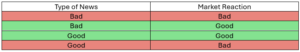

Markets treat news in a variety of ways. There are times when bad news is simply bad news, and the market responds accordingly (down). There are times when bad news is “good news,” and the market responds accordingly (up). As for good news, there are times when good news is good and the market responds accordingly (up) and there are times when good news is bad, and the market responds accordingly (down). If this sounds confusing or I’ve lost you, I’ve created the table below.

So, what happened this week? It could be easy to see Wednesday’s decline in the S&P 500 of more than 2% and a decline in US small cap stocks greater than 4% and think “we must’ve gotten some really bad news.” In this particular case, however, it is our view that the market was reacting badly to good news.

What sparked this week’s selloff was the meeting result of the Federal Reserve Open Market Committee. As expected, the FOMC reduced rates by 0.25% at this meeting, with total cuts of 1.00% to the Fed Funds rate since September. What was not expected, however, was the Fed’s highly scrutinized “dot plots” moving from 3 cuts in 2025 down to 2. These dot plots are simply the estimates of all the members of the committee and change from time to time.

This change in expectations was not liked by the market and the reaction was swift and fierce. But, before making too many assumptions by just looking at price action, let’s look at why the Fed’s thinking has shifted and why that is likely good news.

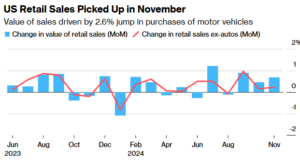

Let’s start with the obviously good news of continued economic growth. In Chairman Powell’s comments he made it very clear that the Fed is positive on the economy. In his comments he cited GDP growth for the third quarter coming in at 2.8%, similar to the second quarter of this year. He also talked about the strength of the US consumer, evidenced this week by a November retail sales figure that bested economists’ forecasts and is shown in the chart below.

Source: Bloomberg

This solid economic growth is underpinned by a labor market characterized by Chairman Powell that is healthy and in greater balance than it was before and during the immediate shock of the COVID-19 pandemic.

This volume of good news is evidence of an economy that isn’t really slowing. An economy that isn’t slowing, on balance, makes the objective of returning to 2% inflation just a little bit harder. Hence the slight change in rate expectations and the market’s reaction to it. Market action like what we’ve seen this week is never fun to experience, but a key tell on whether or not it is likely to accelerate is to understand what is driving it in the first place. If the explanation is as simple as “the U.S. economy has just been remarkable” (Powell’s words this week) then we think this is more likely a correction in an uptrend than the start of something more troublesome.

Written by Alex Durbin, CFA, Chief Investment Officer