Where Could You Make The Most Money?

October 23, 2015

“If you were to close your eyes and not look at the market for the next five years, where do you think you could make the most money?”

We were asked this question at a recent presentation to a group of clients. It’s a fantastic question because everyone always talks about “long-term investing” but the most recent quarterly statement or news headlines are what dominates investor psyches. The question gets to the heart of long-term investing and brings the focus back to fundamentals like price and value.

Our answer to the question: Emerging Market Stocks.

Emerging market stocks have been terrible performers the last few years with the MSCI Emerging Market Index posting negative returns in both 2013 and 2014 – both strong years for the U.S.-based S&P 500. This year, the recent fears of slowing Chinese growth and a rising U.S. dollar caused another wave of fear in emerging markets and the index dropped approximately 18% from June through September.

Seeing those kind numbers are the type of thing that makes investors say “I wouldn’t touch that with a 10-foot pole,” but could it be time to follow the advice of Warren Buffett and “buy when there is blood in the streets?”

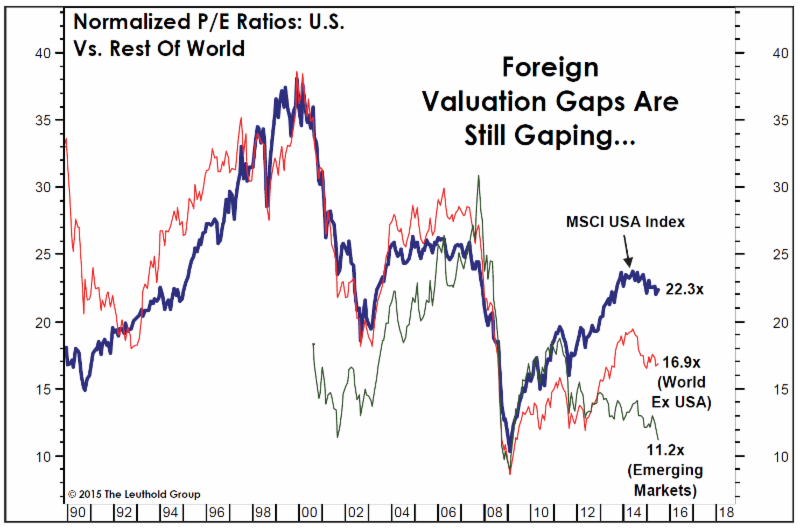

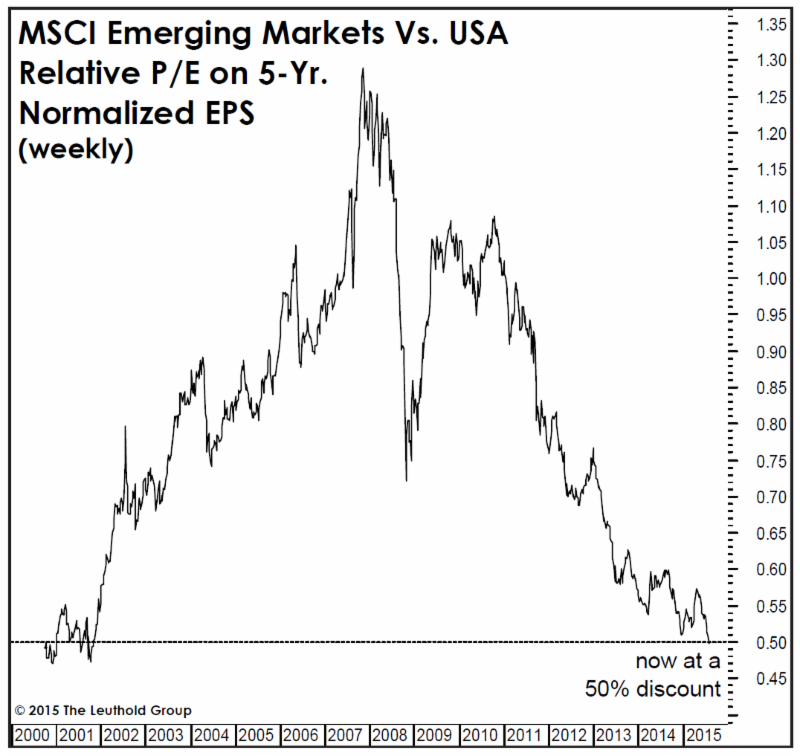

Emerging market stocks are definitely cheap. The chart below compares normalized price to earnings (P/E) ratios for the U.S., foreign stocks as a whole, and emerging markets. In this case, a downward sloping line means “cheaper” and the emerging markets P/E of 11.2 is almost half of the U.S. stock P/E of 22.3.

Source: The Leuthold Group

Source: The Leuthold Group

Since the end of September, markets around the world have rallied, but we’ve seen emerging market stocks bounce the most. It remains to be seen whether the recent increase in emerging market stocks is the start of a new uptrend or a “dead cat bounce” but we do know that being a contrarian and patience are two ingredients of many successful investors. Clients in some of The Joseph Group’s aggressive strategies will note they are receiving trade confirmations adding to emerging market exposures. We think the recent decline represents a value opportunity for long-term investors.