Why Do We Use Five Asset Classes?

July 19, 2018

To Inform:

In this week’s informational WealthNote, we are excited and proud to share our Portfolio Manager Aaron Filbeck, CFA, CAIA, CIPM,’s new whitepaper that explores why we look at the investment universe the way that we do.

Portfolio Manager Aaron Filbeck, CFA, CAIA, CIPM

When our clients are shown a visual representation of one of their portfolios, such as our Provision or Harvest strategies, they see a pie-chart with five different asset classes. The Joseph Group looks at the investment world differently than a traditional “60/40 Moderate” or “80/20 Aggressive” stocks and bonds mix. Instead, we break up the investment universe into five broad asset classes: High-Quality Fixed Income, Credit, Global Stocks, Real Assets, and Dynamic Allocation.

Key Points:

- Our portfolios incorporate more than just a traditional mix of stocks and bonds.

- Each of our five primary asset classes plays a distinct role within a portfolio.

- High-Quality Fixed Income and Credit may both be categorized as bonds, but the underlying risk drivers are completely different.

- We look at the global stock market when making allocations, not just U.S. stocks.

- An allocation to Real Assets may benefit a portfolio in times of accelerating or surprise inflation.

Introduction

When our clients are shown a visual representation of one of their portfolios, such as our Provision or Harvest strategies, they will see a pie-chart with five different asset classes. The Joseph Group looks at the investment world differently than a traditional “60/40 Moderate” or “80/20 Aggressive” stocks and bonds mix. Instead, we break up the investment universe into five broad asset classes:

By breaking up the world into five asset classes, we believe it isolates five primary risk factors that drive future returns and allows us to better align portfolios with the objectives they are designed to achieve.

Asset Classes

High-Quality Fixed Income (Bonds)

High-Quality Fixed Income provides income through interest payments and can benefit a portfolio in a contracting or recessionary economic environment. High-quality bonds typically have high credit ratings, otherwise known as being “above investment grade”. A high credit rating means these bonds carry very little risk of defaulting. The vast majority of these bonds are either issued by governments (such as the United States) or corporations that tend to have lower debt on their books and are in good standing with their creditors. Because of their high-quality nature, these bonds can potentially appreciate in value during times of stock market stress.

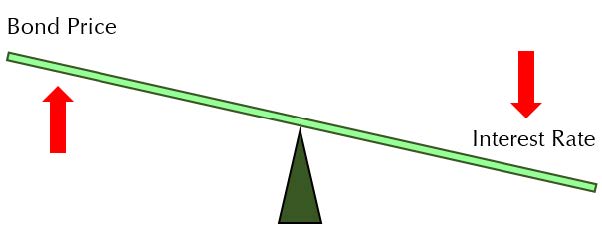

The prices of investment grade bonds are sensitive to changes in interest rates. Think of a government bond that pays 2%. If market interest rates go up, and newly issued bonds from the same government pay 3%, the existing bond paying 2% becomes less attractive. On the other hand, if market interest rates go down and newly issued bonds pay 1%, the existing 2% bond becomes more attractive. We often visualize this relationship between bond prices and market interest rates as a “teeter-totter”:

Source: TJG Global Investment Research

Therefore, we want higher exposure to high-quality bonds when rates are high enough to meet client goals, when we expect market interest rates to decline, or when we are seeking protection in difficult markets.

Credit (High-Yield Bonds)

Credit can be used for two primary purposes: collecting income and “playing offense.” First, because Credit pays a higher interest rate, we can own the asset class for its attractive income stream. Second, Credit can be used as a way to “play offense” in an improving economic environment. Credit, also known as high-yield or “junk bonds,” consists of bonds with lower credit ratings, or “below investment grade.” The companies who issue these bonds have a higher probability of defaulting relative to higher quality issuers. Therefore, to attract investors, they pay a higher rate of interest over and above high-quality bonds, otherwise known as a “spread.” Because these bonds pay a higher interest rate, they are less sensitive to changes in market interest rates. Using the previous example, when market interest rates jump from 2% to 3%, it has very little impact on an investor holding a bond paying 6%. This example illustrates that interest rate risk is not the primary risk driver for the Credit asset class. Instead, the risk with these bonds is not getting repaid from the borrower, or the company defaulting. This risk is reflected in the spread required to attract investors to own the bond – a low risk of default means a lower spread, a high risk of default means a higher spread. Similar to the price sensitivities of high-quality bonds to interest rates, high-yield bond prices are sensitive to the changes in default expectations, as measured by the spread. A decreasing spread drives price appreciation of these bonds, and vice-versa.

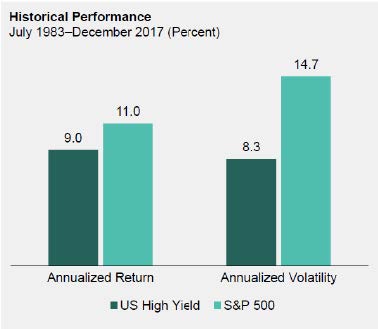

Source: AllianceBernstein, L.P.

Credit tends to perform well in stable and improving market environments when company defaults are low or declining. Over the last 34 years, high yield bonds have achieved 80% of the returns of the S&P 500, with only 60% of the volatility. History shows in periods where spreads are high and declining, Credit has the potential to generate total returns (income and price appreciation) exceeding those of the stock market.

Global Stocks

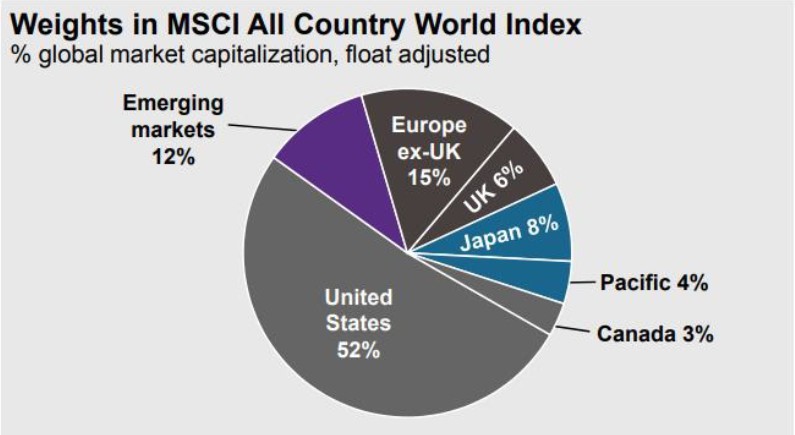

Having an allocation to stocks is meant to be the primary growth engine for a client’s portfolio. We focus on the entire world when considering allocations to stocks, not just the U.S. Rather than looking at a domestic-only index, like the Standard & Poor’s 500, we look at the All Country World Index (ACWI), which includes the United States, developed markets like Europe and Japan, and emerging markets like China, India, etc. Over the long-term, stock markets all over the world have historically been driven by two primary factors: corporate profits and economic growth. When corporate profits and economies are growing, stock markets tend to perform very well. This is because improving economies drive spending, which helps corporate profits. Higher profits lead companies to either reinvest in other growth initiatives or pay shareholders in the form of cash dividends and share repurchases.

Source: JPMorgan Asset Management

Having exposure to stock markets all over the world provides access to different drivers of market growth. In the diagram above, it’s very clear that even though the United States is familiar to us, it only represents half of the global stock market. The economic factors that might drive performance in China or Japan are not necessarily the same as those that drive U.S. stock markets. While stock markets around the world may be affected by different economic factors, the predominant driver of risk and return is simply “market” risk. Stocks tend to perform well in periods where corporate profits are growing and economies are expanding. Because the purpose of having stocks in a portfolio is growth, we want to be invested in attractively valued areas of the market where we believe future growth will be positive and accelerating, driving positive stock returns.

Real Assets

Real Assets are used in client portfolios for growth and protecting against rising or surprise inflation.

The term “Real Assets” refers to something tangible, or “real,” that investors can touch. Research shows real assets are more sensitive to changes in inflation than more traditional assets such as stocks and bonds.

Steady and predictable inflation levels can be healthy for stock and bond investors, but when inflation either accelerates or surprises to the upside, it can be harmful to returns. In a stable inflationary environment, companies can adjust their prices to pass rising inflation down to their consumers, but large surprise changes in inflation can cause companies to lag behind as rising input costs decrease profits.

In our portfolios, Real Assets are divided into three categories:

- Commodities/Natual Resources

- Global Real Estate

- Global Infrastructure

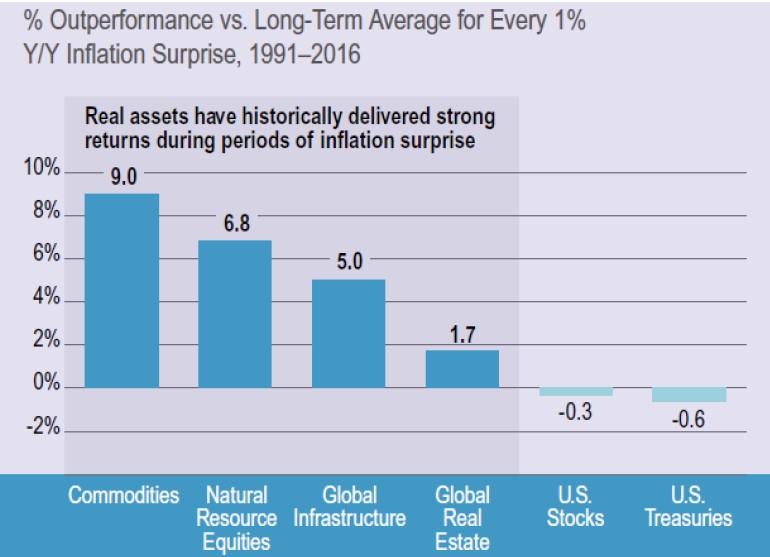

Source: Cohen & Steers

A study by Cohen & Steers shows each of these categories have historically performed well in periods of surprise inflation. Over the long-term, Real Assets should benefit from rising inflation by increasing prices, inflation-adjusted cash flows, or some combination of both. In Joseph Group portfolios, the role of Real Assets is to protect a client’s purchasing power in the event of accelerating or surprise inflation, when other asset classes may not.

Dynamic Allocation

Dynamic managers have the flexibility to use unique strategies and/or make shifts in different ways than The Joseph Group, providing an additional layer of diversification to clients’ total portfolio allocation. Dynamic strategies are where we give the most flexibility to the underlying portfolio manager of each strategy, with the goal of being able to “zig when the market zags.” Due to their flexibility, these strategies are expected to move differently than other asset classes, but still provide our clients with a similar risk and return profile as the rest of the portfolio. Many Dynamic strategies have the flexibility to move quickly in and out of different asset classes, geographies, and individual stocks or bonds. Others may use various trading strategies to be tactical and take advantage of market trends. For example, a Dynamic manager may have the ability to buy stocks they like, while simultaneously “short”, or bet against, stocks they don’t like, effectively trying to benefit from stock picking regardless of the market’s direction. Because these managers have autonomy and flexibility to run their portfolios how they see fit, they often do not take on a single risk driver like the other asset classes. Instead, the risk is manager or strategy itself. The flexibility of each strategy allows each manager to take advantage of short-term opportunities. We often expect Dynamic managers to perform well in volatile markets.

Conclusion

Using five distinct asset classes allows us to be very purposeful about the portfolio risks we are taking in different economic environments. Whether it is playing offense or defense, knowing each asset class’s purpose and primary risk driver provides clarity to the decision-making process when making portfolio shifts in our client accounts.

Isolating the five primary risk factors that drive future returns is vital to The Joseph Group’s investment process. Our goal is to better align portfolios with the objectives they are designed to achieve.

DISCLOSURES

-

This presentation is for general information purposes only. It does not take into account the particular investment objectives, restrictions, tax and financial situation or other needs of any specific client.

-

This information discusses general market activity, industry, or sector trends, or other broad-based economic, market, or political conditions and should not be construed as specific investment advice.

-

Indices are unmanaged. The figures for the index reflect the reinvestment of dividends but do not reflect the deduction of any fees or expenses which could reduce returns. Investors cannot invest directly in indices.

-

The economic and market forecasts are subject to high levels of uncertainty which may affect actual performance. Accordingly, such forecasts should be viewed as merely representative of a broad range of outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. The Joseph Group has no obligation to provide updates or changes to these forecasts

-

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by The Joseph Group to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice.

-

Past performance is not indicative of future results, which may vary. The value of investments and the income from investments can go down as well as up. Future returns are not guaranteed and a loss of principal may occur.

-

You should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from The Joseph Group.

-

The Joseph Group Capital Management is neither a law firm nor accounting firm, and no portion of its services should be construed as legal or accounting advice.

-

Please remember that it remains your responsibility to advise The Joseph Group, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

-

A copy of our current written disclosure statement discussing our advisory services and fees is available upon request. The scope of the services to be provided depends upon the terms of the engagement.