Will The Market Treat Omicron Differently?

December 3, 2021

To Inform:

A week ago, most of us were digesting our Thanksgiving meals and few people had ever heard of the Omicron variant of COVID. That’s certainly changed in the last few days as Omicron has dominated the headlines.

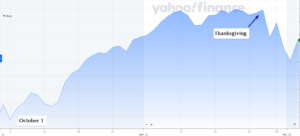

Stock markets have seesawed in the past week with moves in both directions, but the chart below provides some perspective on recent volatility. While the S&P 500 is down a bit more than -2% from the day before Thanksgiving, the popular U.S. stock index remains about 6% higher than at the beginning of the quarter on October 1.

Source: Yahoo Finance

As The Joseph Group’s Investment Strategy Team has discussed the potential market implications of Omicron, our conversations have focused on a key question – could the market treat Omicron differently? Specifically, could Omicron spark even more inflation and exacerbate the current inflationary environment? Let’s unpack what we are discussing.

In general, the market narrative has considered COVID a force which slows the economy and is largely disinflationary. Interest rates have tended to decline when COVID cases rise and stock leadership has focused on technology stocks which can do well if people stay at home and are not out and about. On the other hand, “reopening,” which is associated with declining COVID cases, is considered to lead to an expanding economy (more travel, consumption) and higher interest rates with stock leadership happening in sectors such as financials (banks) and energy (oil) companies. We’ve seen the market swing between both environments throughout 2021.

Our question of whether the market may treat Omicron differently has us considering alternative playbooks as we seek to position portfolios. While we are not epidemiologists, confirmed cases of COVID are likely to rise and we have already seen confirmed cases of Omicron in California and Minnesota. Again, based on the recent past, investors may believe rising COVID cases imply lower interest rates (support for bonds) and stock market leadership coming from tech stocks. We believe a key variable which could make things different is supply chains.

We’ve already seen shipping goods in from overseas and having those goods unloaded at U.S. docks is under severe strain due to lockdowns in foreign countries and worker shortages. While recent data has shown improvement in supply chains, our concern is Omicron may make the trends worse. Playing out our thinking, if foreign countries impose mass lockdowns and workers are quarantined or are otherwise reluctant to work, we could see more constraints on shipping and more shortages of key manufacturing components.

If supply chain problems intensify, our concern is the impact could exacerbate an already challenging inflation environment. Again, we are conjecturing, but let’s play out a scenario. If inflation data accelerates from already high levels, it may force the Fed’s hand to taper bond purchases and increase interest rates even faster than expected. As the Fed seeks to catch up in combating inflation, bonds could come under pressure and if the market believes higher inflation may last for longer, rates on longer maturity bonds may rise and a tailwind for technology stocks could turn into a headwind.

All of this discussion is conjecture, as the world is still gathering data about Omicron, but we go through the thought exercise to be prepared on behalf of our clients. Wall Street may believe the formula of rising COVID cases = lower interest rates + technology stock leadership, but we are not so sure. To quote Mark Twain, “it ain’t what you don’t know that gets you into trouble, it’s what you know for sure that just ain’t so.”

We look forward to sharing more of our thoughts at our next two “Portfolios” events. On December 14, at Portfolio at Your Place, Alex and I will be on Zoom looking back at the market action in 2021 and what we learned from it (register for it here). And stay tuned for an announcement of what has become a Joseph Group tradition of our January “anti-forecast” event: “Forecasts are for Show, While Portfolio Changes are for Dough.” Rather than making a “forecast” of what we think will happen in the next year, we will share our “Major Themes for 2022” and the potential portfolio actions we may take as we see those themes play out (or not play out). We value the trust our clients place in us and we look forward to sharing our thinking as we seek to navigate the market environment ahead.

Written by Travis Upton, Partner, CEO and Chief Investment Officer