Will There Be Another Round of Inflation In 2024?

February 9, 2024

To Inform:

I had an interesting conversation this week with a portfolio strategist at a large investment institution. In our conversation the strategist mentioned an internal debate at his firm that centered around the question of what was more likely – that the US 10-year Treasury Bond hits 2.5% this year or 5-5.5%. The scenarios that would need to play out for these scenarios to be realized require either recession (rates likely go down) or a resurgence in inflation (rates likely revisit their 2023 highs). In last week’s WealthNotes we addressed our view on the likelihood of the former (low). This week, I want to consider the question, “Will we see another spike in inflation?”

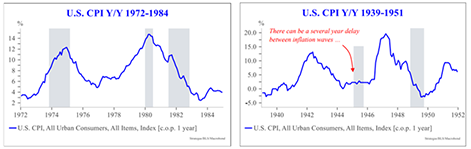

There are a couple of historical examples we can study to consider this question and ask ourselves if there are any parallels today. The most recent historical example of inflation coming in two separate waves was in the 1970s and 1980s. We’ve addressed this in the past and have noted that there were some unique circumstances in this era (demand growth, oil shocks) that helped to ignite inflationary forces not once, but twice. Another period was in the 1940s with a spike occurring during WW2 and another spike shortly after the war ended.

Source: Strategas

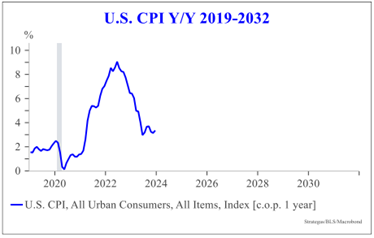

Today there are certainly issues that are geopolitical in nature but fail to rival the experience of the 1940s. And while countries increasingly are attempting to use commodities as a weapon against their adversaries, the balance of power in energy markets has shifted considerably since the 1970s. Are these and other determinants of inflation big enough risks for the chart below to look like the ones above?

Source: Strategas

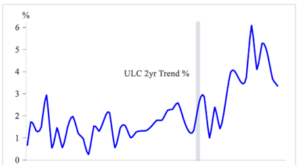

One major factor that will determine some of what happens with regard to inflation is the path for wage growth. We’ve spoken at some length in recent years about how tight the labor market is. There are plenty of jobs, but there are limits to the number of people willing and able to fill them. The way out of this is substantially higher wages (which still may not solve the problem) or increased productivity. The former poses a big challenge for avoiding another wave of inflation, the latter could help squelch it. Labor costs have risen in recent years but are off the boil seen in 2022.

Source: Strategas

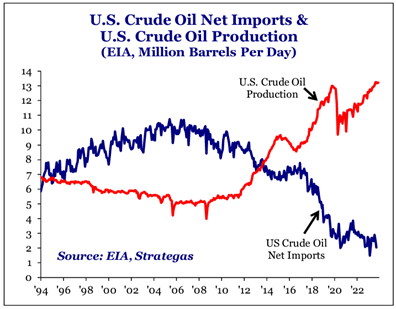

Another major factor in determining the inflation outlook is the path taken by commodities prices, most specifically energy commodities. While 2022 was a tremendous shock to the energy market with Russia’s invasion of Ukraine, it was remarkably short lived. It is possible that the dramatic shift away from imports and toward the production of crude oil in the US enables the economy to handle disruptions to the global supply picture in a much better way than it did in the early 1990s (Iraq) or the 1970s (the entire Middle East).

Source: Strategas

While the debate on where bond yields will end 2024 continues, we think the most likely path for bonds with maturities in the 7–10-year range is that they don’t move much in one direction or another. Based on our view of the economy we don’t think 2.5% is in the cards and based on our view of the determinants of inflation, we see little evidence that another shock is in the near future that would suggest bond yields head back to recent highs. By not “pulling ahead” returns with yields falling (remembering that prices of bonds go up when they do) and not suffering another period like 2022 through Q3 of 2023, we think a “path to nowhere” is the best possible one for investors with bonds as a significant part of their portfolios.

Written by Alex Durbin, Chief Investment Officer