An Asset Class Roundup, American Style

August 8, 2025

To Inform:

Every so often we find it useful to do a roundup of the asset class categories we invest in for our clients at The Joseph Group and to highlight some of the key drivers affecting those asset classes. As you may recall, we view the world through the following lenses: High Quality Bonds, Credit (or “Junk Bonds”), Global Stocks, Real Assets, and Dynamic Funds. Dynamic funds are unique in that they operate in a variety of niches, so for brevity’s sake we’re going to cover the first four.

High Quality Bonds

Starting with High Quality Bonds, it’s worth noting that year-to-date, the Bloomberg US Aggregate Bond Index is up a little over 4.5%. For some time now we’ve been highlighting a couple of beliefs we have about the bond market. One is that rates are likely to be higher for longer. Whether you attribute it to higher debt loads, expectations for higher inflation in the future, or faster economic growth in the years ahead, the US 10-Year Treasury Bond has largely been stuck between 4% and 5% for the last 2 years. Even in “risk off” environments, the yields on longer-dated US Treasury Bonds have remained sticky.

Source: Macrotrends

The other belief we’ve noted is that bonds are more of a “coupon” investment than a total return investment. There are two ways to make money by holding bonds. One is through the interest payment, or coupon, that the issuer provides. The other is through price appreciation should interest rates fall. TJG’s CEO, Travis Upton, often reminds us of the “teeter-totter” like relationship between bond prices and interest rates. When rates fall, bond prices rise, and vice-versa. In the 2010s, as rates steadily fell, bond investors enjoyed decent price appreciation in bonds but little in the way of interest payments. If we are indeed in a “higher for longer” environment, bond investors aren’t likely to see their bond prices rise by much but will receive higher coupons than in a lower rate environment.

Credit

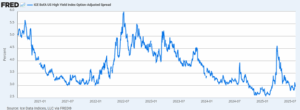

Credit, or “junk bonds” are bonds with investment ratings below what is considered “investment grade.” These are bonds issued by companies that have generally riskier business models or more debt-laden balance sheets. To compensate investors for these risks, investors earn a “spread” above government bonds. Right now, spreads sit at just under 3%. When added to 10-Year Treasury Bond rates of about 4.25%, this means yields on these sorts of bonds fall somewhere around 7.25%. The chart below shows the changing nature of spreads over the last five years. As you can see, we’re back near the lows, indicating a marginally less attractive environment for junk bonds.

Source: St. Louis Federal Reserve

Global Stocks

Global stocks have thoroughly rebounded from the tariff-induced selloff in early April, with indexes across the globe broadly higher this year. International stocks have outpaced US stocks as the dollar has weakened against foreign currencies in 2025. A weaker dollar benefits US investors in foreign stocks as foreign stocks are denominated in their home currencies. Beyond the weaker dollar, countries outside the US have been shaken by a changing global trade and defense landscape, with many foreign countries enacting stimulus measures and their respective central banks cutting interest rates. In the US, we think that investors are increasingly getting comfortable with policy-induced uncertainty, as developments since April have indicated that the Trump administration is willing to deal with trading partners on tariffs. The somewhat messy looking chart below from Strategas indicates the varying nature of tariff policy this year. At one point, it looked like tariffs announced would result in annual tariff revenues of over $600 billion. Since then, levels have come in, indicating a less aggressive trade policy and allaying investors’ fears of recession, with Polymarket odds for a recession in 2025 at just 13%.

Source: Strategas

Real Assets

Real Assets as we define them are commodities or natural resources stocks, real estate investment trusts, and listed infrastructure companies. Our view at The Joseph Group is that an allocation to these types of assets provides cash flow and some degree of sensitivity to inflation. In the inflation shock of 2022, for example, commodities were the only major asset class with a positive annual return. The real estate and infrastructure elements of this asset class tend to move around with interest rates, like bonds, and generally have higher dividends than global stocks.

Our approach of viewing the investment landscape through a wider lens than just stocks and bonds has been a key tool in our effort to build objectives-based portfolios for the clients we have the privilege to serve. What we find encouraging about 2025 is that this philosophy of asset allocation has been particularly useful as the returns between asset classes and various regions has varied quite a bit. This may never strike a chord for the “flavor of the month” investor, but for the investor with clear long-term goals it is something worth sticking to!

Written by Alex Durbin, CFA, Chief Investment Officer