An S&P 500 Index Fund Carol

December 8, 2023

To Inform:

Do you ever wonder how ideas for WealthNotes come about? Earlier this week we had an Investment Strategy Meeting and Investment Analyst, Jake Lindaberry was working on communication concerning the “biggest topic in markets” in the last month to share with our Advisors. Considering most recent client conversations have revolved around the fact that as of November 30th, the S&P 500, which weights stocks by size, was up +20.7% year to date, but the equal weight S&P 500, which weights stocks equally (0.2% in each of 500 stocks) was only up +6.4% over the same period, the biggest topic was easy to define. I then said, “It’s December. What if we tied in the Christmas theme and talked about the Ghosts of Index Fund Past, Present, and Yet to Come?” Alex Durbin looked at me like I was ridiculous and said, “there is no way we are going to do that, but I think you just nailed your topic for WealthNotes.” Thank you for the encouragement, Alex. Here goes.

Ghost of Index Fund Past

The chart below provides a long-term perspective on the difference in performance between the size-weighted S&P 500 (what we are most familiar with) and the equal-weighted S&P 500. I went back to December of 2003 (when there is good index fund tracking data) and compared the performance of two variations of the index. The blue line represents the S&P 500 while the red line represents the equally weighted S&P 500. Over the almost 20-year period, the equally-weighted version of the index has outperformed and as shown in the chart, outperformed through most of the period from 2009 – 2020 (red line above the blue line).

Source: Yahoo Finance – chart from 12/31/2003 – 12/8/2023

Ghost of Index Fund Present

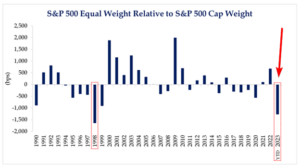

Why is the difference between the S&P 500 and the equally weighted S&P 500 such a hot topic today? It’s because this year the performance gap between the two versions of the index is the widest since 1998.

The S&P 500 is weighted by company size and the largest seven stocks in the index (which Wall Street has coined the Magnificent 7) make up over 28.5% of the index. The other 493 stocks make up the remaining 71.5%. Since March of this year, media attention regarding artificial intelligence has meant stock prices for big technology companies have soared while prices for other areas of the market (the other 493 stocks) haven’t done much of anything. The result, as mentioned previously, is the S&P 500 up +20.7% while the equally weighted version of the index is only up +6.4% through November 30th, a close to 15% gap, which is illustrated in the chart below.

Source: Strategas Research Partners

Ghost of Index Fund Yet to Come

So where are we going looking forward? We point to two facts:

First, according to data from Morningstar, the S&P 500 has a price to earnings (P/E) ratio of 18.8 while the equally weighted version of the index has a P/E of 15.4. The P/E represents how much investors are paying for every dollar of earnings generated by the index and lower is cheaper. Although the two versions of the index are looking at the same stocks, the difference in P/E ratios implies the equally weighted version of the index is about 20% “cheaper.” It’s worth noting the P/E for the “Magnificent 7” is about 29…close to double the valuation of the equal-weight index.

Second, since mid-November, the average stock and hence the equally weighted version of the index is showing some life. In the chart below, when the line is moving up, the size-weighted index is outperforming, but the line moving down means equal weight is outperforming. There is still a lot of ground to make up, but in the last three weeks, the equally weighted S&P has outperformed by about 3%.

Source: Strategas Research Partners

So, what is an investor to do? Fortunately, investors don’t have to wander around in chains like Marley. They can learn from history and realize the future can look very different from the present. In the words of Tiny Tim, God bless us, every one!

Written by Travis Upton, Partner, CEO and Chief Investment Officer