Back to School on Health Savings Accounts: Distributions & Strategies

September 8, 2021

Last year we talked about Health Savings Accounts Health Savings Accounts (HSAs) as a tax saving and wealth building tool (read that article here). Now let’s explore how folks can utilize their HSA account, especially in their retirement years, if they have been using it as a wealth savings vehicle.

If you have been fortunate enough to accumulate a substantial balance in your HSA there are some considerations for how and when to best use those funds. As a reminder, any Qualified Medical Expense withdrawals from your HSA for items such as eyeglasses, x-rays, lab fees, and crutches are always tax-free at any age. For the retiree, here are some other tax-free distributions to consider:

- Medicare Premiums: You can use your HSA to pay certain Medicare expenses including premiums for Parts A, B and D prescription drug coverage. One misconception is that you can utilize your HSA to pay for supplemental policies such as Medigap. This is not the case!

- Long-Term Care Expenses: You can use your HSA to cover part of the cost of a long-term care insurance policy. This can actually be done at any age but with an increasing amount of benefit as you get older.

- Insurance “Bridge”: If you are fortunate to retire prior to age 65 it’s likely you will need health care coverage until you are Medicare eligible at age 65. There are two cases in which you can use your HSA to continue paying health coverage: 1) An employer-sponsored plan under COBRA and 2) if paying premiums while receiving unemployment compensation.

When should I take money from my HSA?

There may be specific tax planning opportunities that could be a factor for when and how much to distribute from your HSA. For instance, if you have a year where medical expenses exceed 7.5% of your Adjusted Gross Income it may be better to hold off withdrawing funds from your HSA account and claim any unreimbursed medical expenses as a deduction on Schedule A of your tax return. Then, in future years where medical expenses do not exceed 7.5% of your Adjusted Gross Income, it may be more advantageous to begin spending down the HSA again.

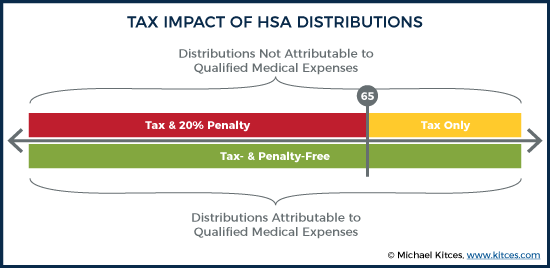

There are other considerations when viewing an HSA as a wealth spending tool. Keep in mind there are no required minimum distributions to an HSA like an IRA. A potential strategy for a retiree’s distribution phase of their overall portfolio may be to utilize the HSA prior to utilizing an IRA (especially in those years before those required IRA distributions start) even for nonqualified taxable expenses. These nonqualified expenses are free of the 20% penalty prior to taking it from the HSA before age 65 but will be subject to federal and state taxes.

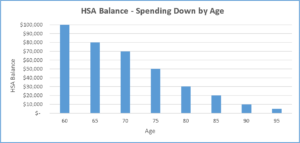

Utilizing an HSA before an IRA helps reduce the chance of having a significant HSA balance remaining upon the account owner’s death. One significant drawback of having any HSA balance remaining upon death is it will be considered taxable to your beneficiaries if left to anyone other than a spouse. As retirees begin to dip into their overall nest egg for ongoing retirement expenses an HSA “distribution curve” could look like the graph below.

Notice as time goes on the balance is gradually reducing the taxable amount left to non-spouse beneficiaries. This type of HSA distribution curve would be ideal.

We’ve only scratched the surface on HSA planning, and everyone’s situation is unique. As you consider how best to plan for your Health Savings Account, please reach out to the Joseph Group – we love to help!

Written by Jeff A. Tudor, CRPS, Client Advisor