Charts Worth Seeing Again

January 21, 2022

To Inform:

Financial markets have gotten off to a volatile start in 2022 with interest rates rising and the closely watched S&P 500 index of U.S. stocks down approximately -6% (through January 20) with many technology stocks down even more.

Within our Investment Strategy Team meetings, we’ve said that when the market has a more normal correction, it’s going to emotionally feel especially rough after a period of such low volatility. What do we mean by that?

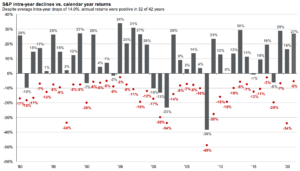

Each quarter, JP Morgan includes the chart below in their Guide to the Markets as a way to provide big picture perspective concerning market volatility. The red dots reflect the biggest drawdown within a calendar year, while the bars reflect the final calendar year total return. Since 1980, the S&P 500 has experienced an average intra-year drop of -14% each year, despite overall returns being positive in 32 out of 42 years. Last year, the S&P 500’s biggest drawdown was only -5%, tied for the 3rd smallest red dot on the page. Said differently, last year’s volatility was historically low given the last 42 years, and the recent volatility, while still small in the context of history, is already a big difference from last years’ experience.

Source: JP Morgan Guide to the Markets

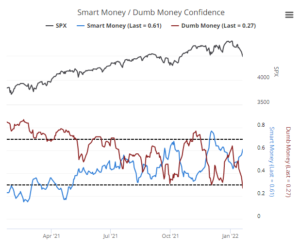

When we see times of heightened volatility, we often get the question, “is this a buying opportunity?” One of our favorite tools to address this question is investor sentiment. While no timing tool is perfect, extremes in investor sentiment can often indicate higher probability opportunities. Long-time WealthNotes readers will recognize the chart below as our favorite sentiment indicator, the Smart Money/Dumb Money Index. In general, we want to follow the logic of “smart money” institutional hedgers and do the opposite of more emotional “dumb money” individual investors. Most of the time the data here is just noise, but when there are opposite extremes in behavior, it can indicate a higher probability of important market opportunities. This is especially true when the “smart money” is optimistic and the “dumb money” is at a pessimistic extreme – historically this set up has been consistent with attractive buying opportunities. Based on the current data, the red line (dumb money) has moved to a pessimistic extreme, as the smart money is rising. The “fat pitch” buying opportunity isn’t there yet, but based on sentiment, a strong buying opportunity may be getting closer.

Source: Sentimentrader.com, Sundial Capital Research as of 1/20/2022

When I was on the phone yesterday with a client, he asked if I was concerned about the Fed raising rates causing a bigger market correction and potentially a bear market. I told the client “we are less concerned about the first rate hike than we are the last one.” My comment was a pithy way of explaining that historically, the Fed hiking rates is typically consistent with a later stage in the cycle where the economy is strong, unemployment is low, and corporate profits are robust. The later stage in the cycle typically has more volatility, but stocks are still one of the best asset classes, driven by continued earnings. In other words, the Fed starting to hike rates reflects a shift from a growth phase to a mature growth phase of the economic cycle. I went on to explain how the last rate hike, whenever it may be, is typically associated with a shift in the cycle from mature growth to decline. Big picture, the current economic environment is still consistent with mature growth, where we can expect rate hikes and higher volatility, but is still a ways from declining corporate profits and a recessionary economy.

The phrase “we are less concerned about the first rate hike than we are the last one” is one of our seven themes for approaching the markets in 2022. Next week we will host our January “Portfolios at Your Place” where Alex and I will discuss this theme along with six more for 2022 and what those themes may imply for making portfolio decisions throughout the year. We would love for you to be part of the discussion and invite you to join us – you can register here.

Written by Travis Upton, Partner, CEO and Chief Investment Officer